Here Is the Proof of Why Rare Earths are Going to the Moon

November 29, 2022

7 Things You Should Know Before Purchasing Strategic Metals

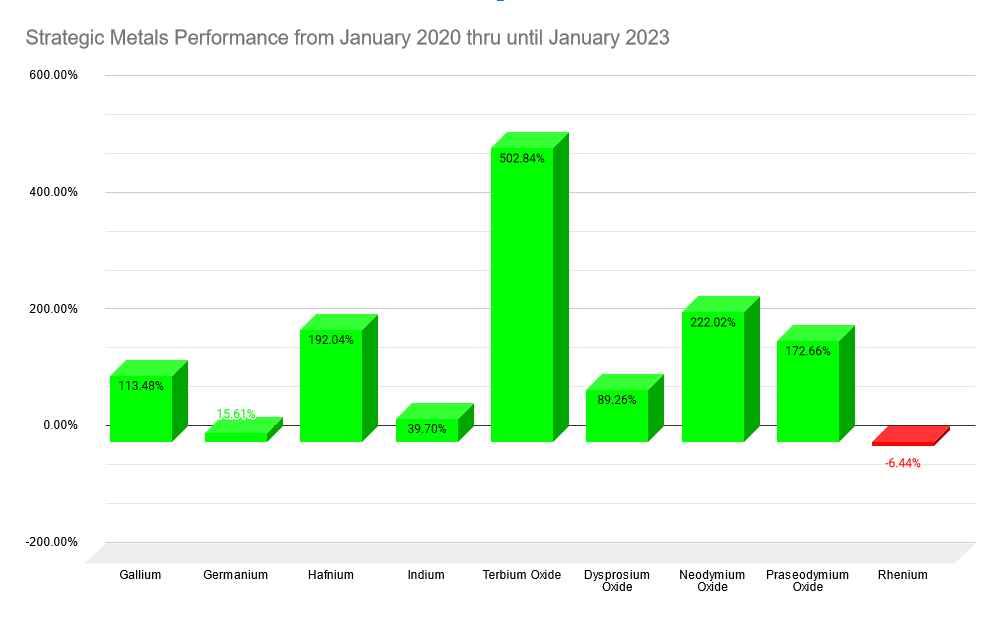

March 1, 2023We are pleased to publish our first performance update of 2023. We are even more pleased that the gains for our private investors continue to rise. See the chart below:

That way, our private investors enjoy a stable base portfolio to begin with and are invested in just about every industry one can imagine.

This also provides each client with diversification within their purchased portfolio. This is important in the long play, as we will demonstrate here now.

The numbers can be deceiving even though they are excellent gains; they are only excellent gains because of the long play.

We want all of our prospective clients to understand our recommendation fully, and we only have one recommendation which is to purchase all 9 Rare Earths. Why? Because supply and demand are in charge, and we have no way of knowing which particular metal (s) will “spike” because of a short-term increase in demand and an inability for supply to increase in that short term. It happens all the time.

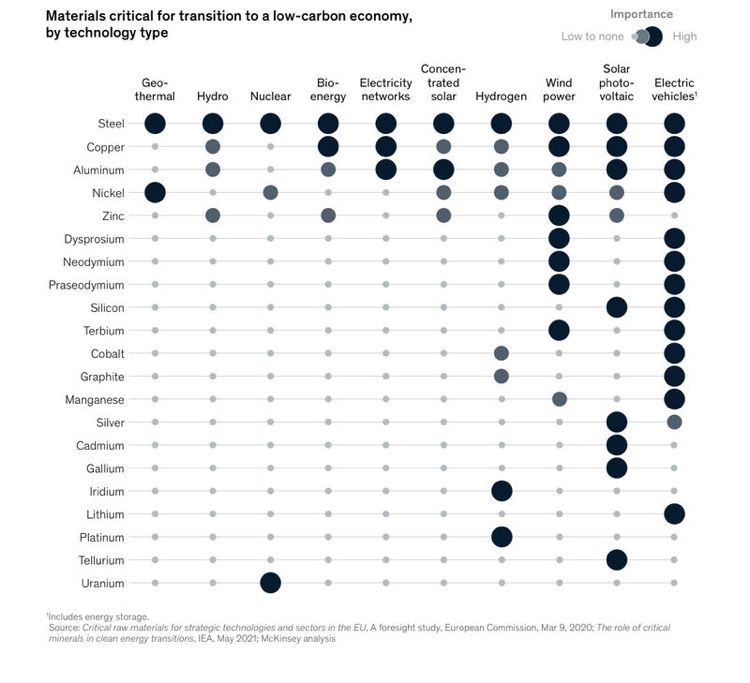

There is only one thing we are certain of: over the long term, 3 to 5 years, 10 years even better, that demand is heading towards 9 times greater than supply. Here are some examples …

As you can see some Rare Earths have increased considerably more in value than others.

Terbium, for example, is up 500% in 3 years, representing a very tasty return of 166% per annum. However, most of that spike occurred between July 2020 and July 2022, and the price has now stabilized, more or less, still increasing, just not at the rate it was.

Another example is Hafnium, up 177% in 2022 alone. Why? The demand for Hafnium from the aviation and aerospace industries surged last year. We had a prime example of demand increasing in the short term and supply not being able to increase in the short term.

If you do the math, based on the performance chart above, you will determine that our clients who purchased in January 2020 have realized average gains of 50% every year for the decade.

However, what is also true is that clients who purchased last year are up just an average of 20% and not 50%. And that gain is mainly supported by the dramatic price increase in Hafnium in 2022. Some of the other metals did in fact decrease slightly in value last year.

The main point we want to communicate is the gains are very healthy in the long term.

Our recommendation is to purchase all 9 metals and plan to stay in for at least 3 to 5 years, 10 years even better. This is not a 6-month play, even though one metal might increase 81% in 3 months.

Unless, of course, you know something we don’t about a certain metal or industry, then please go for it. It is your purchase, and we will happily accept and facilitate any variation of metals purchase you desire.

One great example this year is we had a client insist on purchasing only Hafnium in September. Now bear in mind Hafnium is already up 90% at this point. Well, lo and behold, Hafnium is up another 80% since then, so the client’s purchase is up 80% in 3 months.

I hope we have made some sense here.

Owning Rare Earths as physical assets is a new, imaginative, profitable, alternative asset class, and our only recommendation is to diversify by purchasing all 9 metals available and stay in for 3 to 5 years.

In the final analysis, Rare Earths are up an average of 50% yearly so far this decade. In comparison, Rare Earths were up an average of 34.25% yearly for the previous 5 years. As an investment, the gains are getting better.

It is still early, and we expect to see shortages and supply chain bottlenecks in the coming 5 to 10 years. Why? Because China dominates Rare Earths. China processes and refines 90% of the world’s Rare Earths. Why? Because they need them to grow their own domestic consumer economy. We will see continued shortages from time to time as China continues to restrict export quotas to satisfy its own domestic needs. The goal of the Chinese government is for their domestic consumer economy to equal and eventually exceed their export economy. China is barely halfway there, with maybe half of China on the grid. They have BIG plans for solar power, wind turbines, electric cars, and on and on…

Please contact us if you have questions or would like to investigate further.