Rare Earths &

Technology Metals

- New Alternative Asset Class

- Inflation & Crisis Proof

- Wealth Preservation

- Unique Investment Strategy

- Outperformed Stocks & Gold

The Opportunity

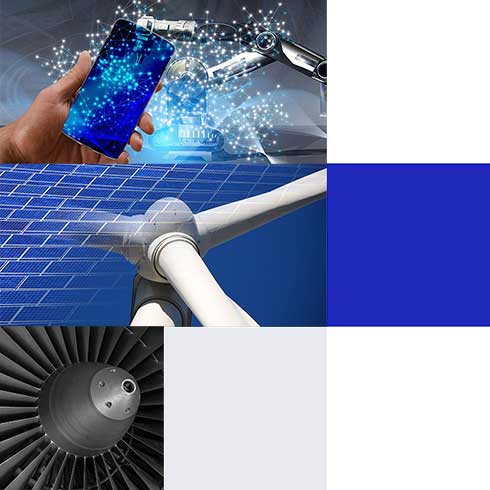

Strategic Metals are the backbone of manufacturing in the 21st century. When you own strategic metals & rare earths as physical assets, you own the downstream raw materials that ultimately become trillions of dollars in upstream GDP in high-tech products such as mobile phones, electric cars, wind turbines, solar power, jet engines, computer chips, fibre optic cables, and many more.

Strategic Metals are crucial to all nations’ economic prosperity and, increasingly, security capabilities!

But … supply is limited, and China monopolizes more than 80% of global production.

Supply is also inflexible, meaning when demand increases, production is rigid because strategic metals are always a by-product of mining another raw material.

You can benefit from this situation by purchasing these strategic metals as tangible assets.

Key Benefits:

- You purchase a physical, tangible asset (similar to buying gold bullion bars) that is considered inflation- and crisis-proof.

- The value of your asset is purely based on the demand and supply and not on its perceived value (i.e., the value of your asset is not correlated with the stock market). A mixed basket of our Strategic Metals has outperformed stocks and gold over the past 5 years.

- The demand for your asset is strong and growing as strategic metals are needed in many high-tech products whose own demand is increasing with the growing world population, the industrialization of emerging countries, and various government policies.

- The supply of your asset is finite, and 80% is coming from China, which is stockpiling and considering export restrictions. These technology metals and rare earth elements are considered “critical” to economic and national security by Europe, the US, and other industrialized nations.

- You purchase directly from one of the best-known global dealers in technology metals and rare earth elements (i.e., no middleman) and receive proof of ownership, which comes with an industrial certification (min. purchase amount is $10,000).

Download Brochure

Please complete the form below to instantly receive our PDF brochure with more information about this future-proof investment opportunity:

Purchase Options

The 5 technology metals and 4 rare earth elements we offer to private clients are those which, based on more than 25 years of experience in the industry, are considered the best tangible assets for investors in the medium and long term.

These are:

Rare Earth Elements

4 rare earths whose supply is controlled for 80% by China and which are considered critical to several industries.

You can purchase them in any combination, and our metal experts will be happy to help you choose (min. purchase $10,000). A popular choice is a basket of all technology metals & rare earths (up 162% since 1st Jan 2020).

Why us?

Why purchase strategic metals through us and our business partner TRADIUM:

No Intermediaries

Buy direct from leading certified importer. All metals and rare earths come direct from producers with complete supply chain guaranteed.

Benefit from 25+ Years Experience

The selection offered to private investors is optimally matched in form and purity to the requirements of the industry, so they are most likely to appreciate in value and can be liquidated easily.

Optimal Storage

Your technology metals and rare earth elements are stored according to banking level standards. They remain in their original packaging so they can be sold quickly to the industrial customers.