Silver Prices

The current price of Silver is $1,218.43 per kilogram.

Please note that the price provided above is the retail price for private investors and is aligned with industry retail pricing. For bulk silver purchases, whether investment or industry, please contact us directly for a quotation.

Table: Silver Historical Prices and Price Changes

| Date | Silver Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Jul 08 2025 | $1,218.43 / kg | ||

| Jan 1 2025 | $973.47 / kg | +25.16% | |

| Jan 1 2024 | $810.37 / kg | +50.35% | +20.13% |

| Jan 1 2023 | $851.51 / kg | +43.09% | -4.83% |

| Jan 1 2022 | $800.72 / kg | +52.17% | +6.34% |

| Jan 1 2021 | $929.47 / kg | +31.09% | -13.85% |

| Jan 1 2020 | $633.17 / kg | +92.43% | +46.80% |

| Jan 1 2019 | $541.10 / kg | +125.18% | +17.02% |

| Jan 1 2018 | $596.13 / kg | +104.39% | -9.23% |

Silver Historical Price Movement

At today’s price of $1,218.43 per kilo, silver changed +25.16% in value this year and is up +50.35% so far since the start of last year. Since the start of 2023 it has changed +43.09% and since the 1st of January 2022, it has gained +52.17%.

Compared to silver’s price of $633.17 per kilo on Jan 1st 2020, this precious metal has gained +92.43% today. Going back to Jan 1st 2018, when one kilogram of silver cost $596.13, the price has gone up with +104.39%.

Silver is a lustrous, soft, white precious metal with the chemical element symbol Ag and atomic number 47.

Silver Uses

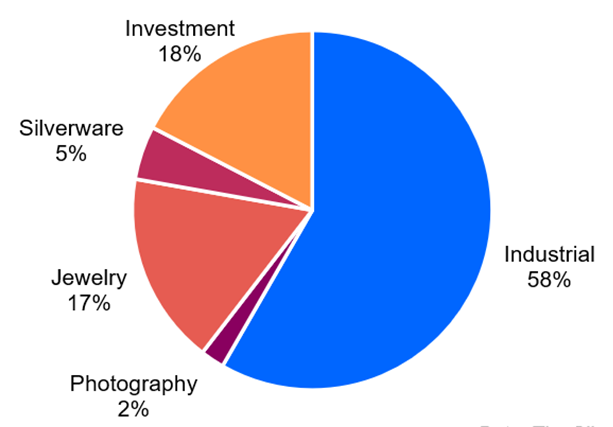

Silver demand by source, according to the Silver Institute 2024

Silver has diverse applications across various sectors, including industrial, investment, and jewellery. Its high conductivity makes it crucial for electronic devices, accounting for a significant portion of its demand. It’s used in circuit boards, solar panels, and electric vehicle batteries. With the rise of renewable energy and electric cars, the demand for silver in this area will continue to grow.

In fact, the EV industry already accounts for 2.9% of global silver demand while the solar industry accounts for 16% of the global demand, growing 14% per year over the past 10 years.

Silver remains popular in jewellery due to its malleability and attractive appearance. Sterling silver, an alloy of 92.5% silver and 7.5% other metals, is a staple for fine jewellery, tableware, and decorative items.

Silver’s antibacterial properties make it essential in medical applications. Silver-based wound dressings, catheters, and medical devices help prevent infections and accelerate healing. Moreover, silver is used in water purification systems due to its ability to destroy harmful bacteria.

Finally, silver is a key component in the production of photographic films, though this usage has decreased due to digital photography. However, it is still used in specialized film applications like X-rays.

Where is Silver Produced?

Mexico, Peru, and China are the largest silver producers globally. Mexico leads the world in silver output, producing 5,000 tons per year, which is 20% of the annual global production. Other major producers include Russia, Bolivia, and Australia. The refining of silver often occurs alongside other metals, such as lead, zinc, and copper.

With limited global resources and growing demand from various industries, mining remains essential to maintain a stable supply. However, silver recycling also contributes significantly to the overall supply, accounting for around 20% of annual global silver production.

What Factors Determine the Price of Silver?

The interplay between supply and demand, market speculation, and macroeconomic factors influences the price of silver. Industrial demand is a significant driver, as silver’s role in electronics, solar panels, and medical applications continues to expand.

The interplay between supply and demand, market speculation, and macroeconomic factors influences the price of silver. Industrial demand is a significant driver, as silver’s role in electronics, solar panels, and medical applications continues to expand.

Investors also impact silver prices, especially in uncertain economic times, as silver is considered a hedge against inflation and currency fluctuations. This investment demand often fluctuates based on geopolitical tensions, monetary policy changes, and market sentiment.

Lastly, the supply side can affect prices due to geopolitical issues, labor strikes, or regulatory changes. As silver mining is often tied to the extraction of other metals, disruptions in mining operations can create significant fluctuations in supply.

Silver Price Forecast

As the push towards renewable energy continues, demand for silver will remain strong. Solar energy projects and electric vehicle production are both expected to drive significant demand. Coupled with its growing use in electronics and medical applications, the industrial demand for silver will likely sustain price growth.

However, the supply side presents challenges. Silver mining operations face environmental scrutiny, while geopolitical tensions could impact key mining regions. This uncertainty can lead to volatile prices but also opportunities for informed investors.

Analysts believe silver, currently at $1,218.43 per kilogram, remains undervalued in 2025 compared to its historical prices, with supply risks and growing demand suggesting strong investment potential. Investors should remain aware of short-term fluctuations while considering the long-term bullish prospects.

How to Buy Silver

Investing in silver can be done through physical silver, such as bars and coins, or financial instruments like Exchange Traded Funds (ETFs) and futures contracts.

When purchasing physical silver, it’s essential to verify purity and authenticity. Established dealers with certified storage options, like us, help ensure the safety of your investment.

ETFs and futures contracts offer exposure to silver prices without the need for physical storage. However, these financial instruments are subject to market fluctuations and can require a more hands-on investment approach.

How to Sell Silver

Selling silver requires verification of purity and value. Potential buyers often seek documentation regarding the authenticity of silver products.

For investors storing their silver with a reputable dealer, the liquidation process is generally straightforward. Funds are quickly transferred to the investor’s preferred account.

Partnering with reputable dealers like TRADIUM, who offer proper certification and storage facilities, ensures a smooth selling process, whether dealing with individual buyers or industrial clients seeking high-grade certified silver.

All prices on this page last updated Jul 08 2025.