Dysprosium Prices

The current price of Dysprosium is $453.90 per kg.

Please note that the price provided is the retail price for private investors and is aligned with industry retail pricing. For bulk purchases, whether investment or industry, please contact us directly for a quotation.

Table: Dysprosium Historical Prices and Price Changes

| Date | Dysprosium Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Jul 18 2025 | $453.90 / kg | ||

| Jan 1 2025 | $353.10 / kg | +28.55% | |

| Jan 1 2024 | $587.40 / kg | –22.73% | -40.49% |

| Jan 1 2023 | $653.40 / kg | –30.53% | -10.10% |

| Jan 1 2022 | $769.60 / kg | –41.02% | -15.10% |

| Jan 1 2021 | $411.10 / kg | +10.41% | +87.21% |

| Jan 1 2020 | $345.24 / kg | +31.47% | +19.08% |

| Jan 1 2019 | $238.14 / kg | +90.60% | +44.97% |

| Jan 1 2018 | $238.14 / kg | +90.60% | 0% |

Dysprosium Historical Price Movement

At today’s price of $453.90 per kg, dysprosium changed +28.55% since 1st Jan 2024. It lost –22.73% since the start of last year and –30.53% since the start of 2023.

The price changed +10.41% compared to its price of $411.10 per kg on Jan 1st 2021 and +31.47% since Jan 1st 2020. If we go back further than 5 years to Jan 1st 2018, when the cost of one kg dysprosium was $238.14, then the increase is +90.60%.

To get a full picture of the potential price trajectory for dysprosium, let’s explore its myriad uses and delve into which countries produce it the most. Armed with this knowledge, we can make more informed predictions about what lies ahead (jump to forecast).

Dysprosium is a chemical element with the symbol Dy and atomic number 66. It is a rare earth element with a metallic silver luster.

Dysprosium is seldom encountered as a free element in nature and is usually found in minerals such as xenotime, dysprosium-yttrium fluorite, gadolinite and euxenite. 32Dy makes up about 0.06% of the Earth’s crust.

Dysprosium Uses

Dysprosium Powder

Dysprosium has unusual magnetic properties, and it is dysprosium that gives neodymium-based magnets their exceptional strength compared to other magnets made from only rare-earth metals. This rare earth metal has a high coefficient of thermal expansion and contains phosphate for medical purposes. Applicants in today’s industry include glass plant construction and dysprosium lasers for early diagnosis of prostate cancer.

Dysprosium is also used as an alloying agent in dysprosium iron alloys used in control rods of nuclear reactors because of its neutron-absorbing properties.

Dysprosium’s most important applications are in their infancy, as it will play an integral part in our global transition to low-carbon economies. It is one of the “energy transition metals” that are essential to many technologies being developed to address climate change.

This rare earth element is listed as a critical raw material in the production of electric vehicles, wind turbines, solar energy production, and energy-efficient lighting. It is also estimated that the demand for “energy transition metals” will not peak until the 2040s.

Where is Dysprosium Produced?

Dysprosium is obtained primarily from monazite sand, a mixture of various phosphates. The sources with the highest percentage of contained dysprosium are the ion adsorption clays of Jiangxi Province, China.

China is the world’s largest dysprosium producer, with over 90% of global production. Other producers include Russia, Malaysia, and Australia.

For quite some time now, China has been the dominant market leader in dysprosium and other rare earth elements. However, China has even bigger plans. In May 2023, the Deputy Director of the National Defense Science, Technology, and Industry Bureau said the moment has come for China to “Accelerate our country’s transformation from a ‘big rare earth country’ to a ‘great rare earth power’”.

What Factors Determine the Price of Dysprosium?

The demand for end products that use dysprosium determines the demand for this rare earth element. As mentioned above, dysprosium is vital to a wide range of industries, but considering all nations’ agenda to transition to low carbon economies and current predictions are that the demand for energy transition metals will not peak until the 2040s.

While most rare earths are pretty common in the earth’s crust, the expensive mining and extraction process makes them scarce and valuable. China is by far the largest supplier and refiner of dysprosium and other rare earth elements and hence controls the supply. As such, it’s not just the production limitations determining the supply (and price) but also geopolitical events and China’s export quotas.

When the political landscape is becoming an ever–increasing factor in markets such as dysprosium, this can have a significant impact on prices. Other dynamics that can impact are issues such as alternative energies, trade wars, and subsidies.

The reality is the market for rare earths such as dysprosium is not always transparent, even when demand is increasing, and supply is limited. As a result, there can be volatility in the short term, and it is challenging to predict market movements accurately or sometimes even supply material when needed.

Rapid technological developments are in contrast with expanding timeframes for new supplies to enter the market. This disconnect can push markets into structural deficits.

In conclusion, when you don’t have transparency in the market and a volatile environment, what’s vital are trustworthy partners with longevity and reputation to ensure competitive advantages such as availability and “fair” prices.

Dysprosium Price Forecast

Dysprosium, a linchpin in modern technology, is more than just a rare earth element—it’s a cornerstone for the future, particularly in the rapidly expanding green economy. Essential for everything from nuclear reactors to the high-strength magnets in electric vehicles, wind turbines, and solar panels, dysprosium’s role is set to grow exponentially as the world pivots towards sustainable energy.

Investment in Green Technology: A Sign of Things to Come

The green revolution isn’t just a passing trend; it’s a transformative wave reshaping the global economy. The automotive industry, in particular, is steering billions into electric vehicle (EV) production at an unprecedented rate. As of 2023, global automakers and battery manufacturers are planning to invest a staggering $860 billion by 2030 to electrify their fleets and build out essential infrastructure. This includes nearly $210 billion earmarked for investments in the United States alone, making it the largest market for EV investments globally.

Over the past 2 years, several major automakers have announced significant commitments. For example, Ford alone is investing over $50 billion by 2026 to expand its EV lineup and scale production. General Motors is not far behind, with plans to invest $35 billion in EVs and autonomous vehicles by 2025. These enormous sums underscore the critical demand for raw materials that power this shift—chief among them, dysprosium (source: The White House).

The U.S. Department of Energy’s 2011 Prediction: A Crystal Ball for Today

As far back as 2011, the United States Department of Energy identified dysprosium as the single most critical element for emerging clean energy technologies. They did this because of this rare earth’s wide range of current and projected uses, together with the lack of any immediately suitable replacement. Even their most conservative projections at the time predicted a shortfall of dysprosium before 2015. This urgent need for dysprosium is why it’s not just companies that have been stockpiling dysprosium reserves but countries, too.

China’s Iron Grip on Supply: A Geopolitical Chess Piece

China currently controls almost all dysprosium production (99%) and has historically imposed export quotas to prioritize its domestic industries and wield influence in global trade. With Donald Trump back in the Oval Office, the potential for heightened trade tensions between the two superpowers looms large. During his previous administration, trade disputes significantly impacted rare earth markets, including dysprosium. Analysts expect that similar policies or renewed tariffs could further constrain global dysprosium supply and elevate prices. In fact, as a direct result of the tariff war between the US and China that started on April 2nd, 2025, the price of dysprosium went up 35% within 1 week.

Moreover, China’s ongoing focus on controlling its rare earth industry includes efforts to consolidate production and reduce environmental impacts. While this policy ensures resource longevity, it also limits export volumes, potentially leaving international buyers scrambling for alternative sources amid growing demand.

Dysprosium Price Dynamics: A Volatile Yet Lucrative Market & Future-Ready Investment

The price of dysprosium changed +31.47% since 2020. But this only tells half the story. It doubled in price in 2020/21 (we all remember that period) and has seen a prolonged price correction over the past three years. Analysts forecast the price to increase significantly over the medium term because of the exponential increase in demand (just think “green”) AND China’s constraints in the supply chain.

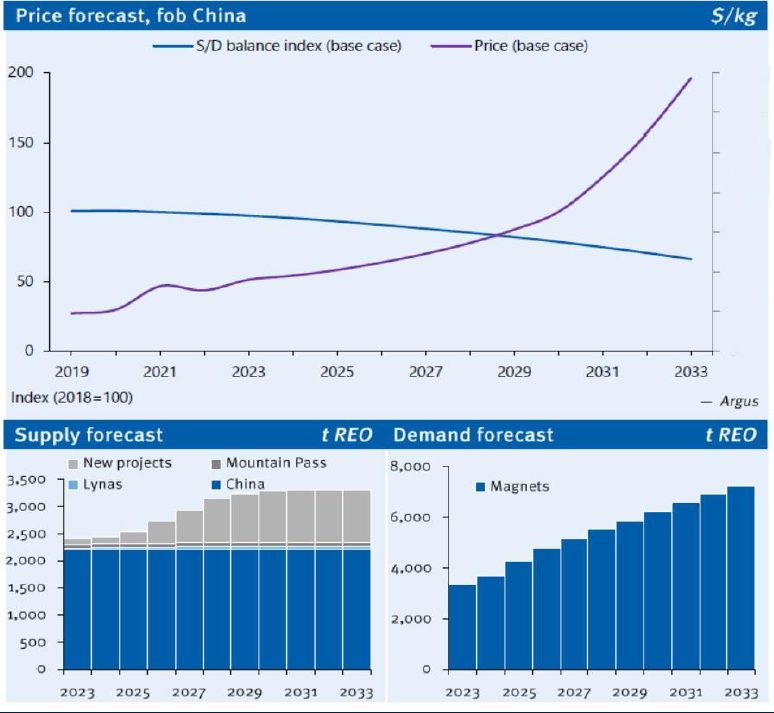

The graphs below show dysprosium’s future price (fob China), as well as demand and supply forecasts by Argus Media. It’s clear that even with some additional dysprosium supply from outside China coming online in the coming years, the demand forecast far outstrips the supply forecast over the next 10 years. This imbalance is why analysts predict the price to quadruple over the next 10 years. Considering the recent price corrections, metals traders consider dysprosium an excellent buy opportunity for investors looking to future-proof their portfolio for the medium to long-term horizon.

How to Buy Dysprosium

Industry-grade dysprosium powder is usually sold at minimum 99.5% purity, priced in USD, and the weight unit is per kilogram. Safe storage is essential because, like many powders, dysprosium may constitute an explosion hazard when mixed with air and an ignition source is present.

Corporate buyers such as Tesla, BMW, Ford, and Mercedes use well-established metal dealers to buy industry-grade dysprosium. Renowned metals dealers, such as ourselves, act as key intermediaries between the high-tech industries and the producers of the critical rare earth elements needed by these industries.

Unless you purchase from a reputable dealer (e.g. if you buy on Amazon, Alibaba, or eBay), there’s no guarantee of purity and no possibility of liquidation to anyone other than hobbyists.

Any discerning investors who want to benefit from future price increases by purchasing and owning some dysprosium can do this through us. By doing so, you are buying from the only globally licensed industry supplier offering this option to private investors.

Dysprosium futures contracts can also be traded in the Shanghai Metal Market (SMM).

How to Sell Dysprosium

Please note that the only end buyers for your industrial-grade dysprosium are industry buyers such as General Motors, Honda, Tesla, Apple, and First Solar. These buyers will only buy from established industry suppliers with documentary evidence of the complete chain of custody. They don’t buy from the likes of eBay, Alibaba, or Amazon.

No industry buyer will transact with a seller that cannot provide the entire chain of custody documentation, analysis & purity reports, and proper storage facilities. We guarantee the fast and safe liquidation of the rare earth elements of our investors because we’re such an industry supplier.

All prices on this page last updated Jul 18 2025.