Gallium Prices

The current price of Gallium is $1,056.70 per kg.

Please note that the price provided is the retail price for private investors and is aligned with industry retail pricing. For bulk purchases, whether investment or industry, please contact us directly for a quotation.

Table: Gallium Historical Prices and Price Changes

| Date | Gallium Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Jul 18 2025 | $1,056.70 / kg | ||

| Jan 1 2025 | $940.50 / kg | +12.36% | |

| Jan 1 2024 | $755.80 / kg | +39.81% | +23.20% |

| Jan 1 2023 | $640.80 / kg | +64.90% | +17.95% |

| Jan 1 2022 | $648.80 / kg | +62.87% | -1.23% |

| Jan 1 2021 | $422.70 / kg | +149.99% | +53.49% |

| Jan 1 2020 | $298.20 / kg | +254.36% | +41.75% |

| Jan 1 2019 | $355.85 / kg | +196.95% | -16.20% |

| Jan 1 2018 | $274.37 / kg | +285.14% | +29.70% |

Gallium Historical Price Movement

At today’s price of $1,056.70 per kg, gallium changed +12.36% since Jan 1st 2025, and +39.81% since the start of last year. It is up +149.99% compared to its price of $422.70 per kg on Jan 1st 2021 and increased +254.36% since Jan 1st 2020 (in comparison, the S&P 500 is up +83.58% over the same period). If we go back to Jan 1st 2018, when the cost of gallium was $274.37 per kg, then the increase is +285.14%.

The price of gallium has been volatile in recent years due to fluctuations in supply and demand. In 2020, the cost of gallium surged due to a shortage of bauxite, the primary raw material used to produce gallium. The shortage was caused by a combination of the Covid-19 pandemic and delays in mining operations and inspections in China, the world’s largest producer of gallium.

As a result of the price increase, many companies that use gallium had to cut back on production or find alternative sources of supply. The price increases were a major factor in the slowdown of the global economy in 2020. Last year’s price increase was caused by China effectively banning the export of this strategic metal to the West in August 2023 (more on this in the forecast section below).

To make an educated forecast on the price of gallium, let’s take a closer look at the uses of gallium, its production, and the key factors that will drive the cost of gallium in the future (jump to our forecast).

Gallium Uses

Gallium

Gallium is a chemical element with the symbol Ga and atomic number 31. Gallium is a soft, silvery metal, and Elemental gallium is a liquid at temperatures greater than 29.76C (85.57F) (slightly above room temperature).

Solid gallium alloys are used in optics, electronics, and nuclear engineering because of their non-toxicity and resistance to neutron radiation and beta decay.

In addition, gallium is used in alloys with other metals such as aluminum, copper, and tin to create gallium arsenide (GaAs). This is used in semiconductor fabrication, one of gallium’s most important uses. It provides a critical component in multiple steps of the manufacturing process for computer chips and other electronic devices.

Gallium nitride (GaN) is another important compound of gallium that has applications in light-emitting diodes (LEDs), laser diodes, power amplifiers, and solar cells.

Where is Gallium Produced?

Gallium isn’t found in nature in its pure form, but it’s obtained as a by-product of aluminum and zinc production. The top 3 producers of raw gallium are China, Germany, and Kazachstan, but … China produces more than 95%!!!

What Factors Determine the Price of Gallium?

In metals, supply and demand is always in charge, and the price of Gallium is determined purely by the market.

The demand for gallium is driven by the need for the final products that use this strategic metal. As noted above, gallium has various vital uses, such as in solar panels, computer chips, and TVs. So, increased solar panel sales would lead to increased gallium demand.

The high scarcity of gallium is a crucial factor that determines the asking price. As China dominates the production of gallium, geopolitical events and export quotas also impact gallium supply.

By understanding how the supply and demand of this rare metal work, we can better understand where gallium prices are headed.

Gallium Price Forecast

As the global economy becomes increasingly dependent on advanced technology, the demand for gallium, a critical component in modern electronics, continues to soar. Last year, gallium prices surged by 23.20%, following a 17.95% increase in 2023. This rapid price appreciation is fueled by several key factors, including rising demand from the semiconductor, telecommunications, and renewable energy sectors.

Gallium is essential for numerous high-tech applications, from gallium arsenide chipsets used in 5G base stations to the highly efficient gallium nitride (GaN) components found in military radar, laser technologies, and satellites. Its strategic significance makes it one of 35 elements the US government, alongside Europe, considers a national security concern.

However, gallium’s importance extends far beyond telecommunications. The metal’s critical role in renewable energy sectors is equally impactful. Thin-film solar panels, for instance, rely heavily on gallium for their high efficiency. Europe alone is projected to consume 7 to 26 times more gallium by 2030 compared to current levels, according to the Fraunhofer Institute.

Adding complexity to the market is the ongoing supply crunch. China, which controls approximately 95% of the world’s gallium production, has leveraged its dominance to significant effect. The export restrictions imposed in August 2023, restricting gallium exports to the US, EU, and Japan, pushed gallium prices higher as Western companies scrambled to secure limited supplies.

Trade tensions were poised to escalate following Donald Trump’s re-election, with his administration doubling down on its hardline policies toward China. China wasted no time responding, announcing a sweeping export ban on gallium shipments to the US on December 8, 2024. This bold move underscores the growing geopolitical rift and intensifies the strain on gallium’s already limited supply, setting the stage for further price surges in 2025.

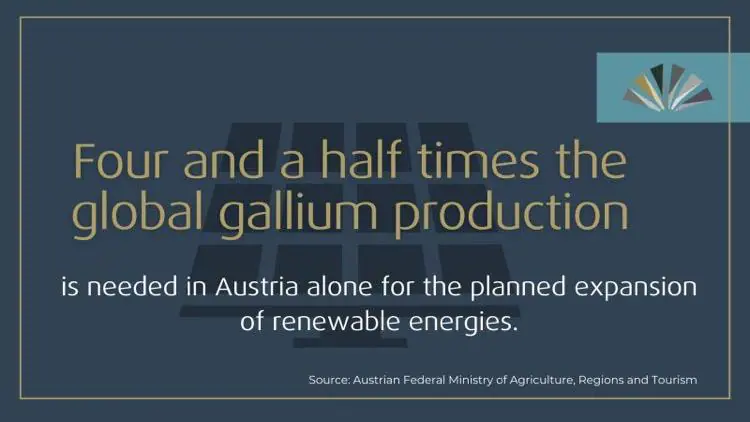

Austria provides a telling example of the looming supply-demand gap. Despite its relatively small population of 9 million, Austria’s planned renewable energy projects are estimated to require 4.5 times the current global gallium production. This staggering statistic underscores the scale of the impending shortfall as gallium becomes integral to both energy independence and environmental commitments.

Meanwhile, China continues to limit exports while ramping up domestic consumption. Tech giant Huawei, a leader in gallium-based technologies, holds over 2,000 gallium-related patents and is well-positioned to dominate the global market for gallium-integrated semiconductors for years to come. This dynamic leaves Western countries at a severe disadvantage, relying on a supply chain controlled by an increasingly assertive China.

The West’s efforts to counterbalance China’s dominance are further hindered by a significant disparity in human capital. While China graduates 200 metallurgists a week, the US produces the same number annually. With over 400,000 people employed in China’s rare earths and technology metals sectors compared to just 400 in the US, rebuilding expertise and infrastructure outside of China could take a generation or more.

For now, the US and Europe remain dependent on whatever gallium China is willing to export after meeting its domestic needs. The recent export ban highlights China’s strategic leverage, and with gallium’s vital role in national security and economic development, further restrictions or price increases seem inevitable. As the Trump administration tightens its stance on Beijing, gallium could become a focal point in the broader geopolitical rivalry.

With demand rising across critical industries, from telecommunications to renewable energy, and supply remaining constrained, gallium prices are expected to remain under pressure. Analysts forecast a continued upward trajectory in the medium term, driven by its indispensability in high-tech sectors and ongoing supply shortages. As tensions escalate, gallium could become the latest flashpoint in the global competition for strategic resources.

How to Buy Gallium

Gallium is sold at 99.99 percent purity, priced in USD, and the weight unit is per kilogram. Anyone, such as hobbyists, can buy small amounts of gallium on Amazon, Alibaba, or eBay. However, there is no guarantee of purity and no possibility of liquidation to anyone other than other hobbyists.

Corporate buyers such as LG, Nokia, Qualcomm, and Sony use well-established metal dealers to purchase industry-grade gallium. Reputable metals dealers, such as ourselves, act as key intermediaries between the high-tech industries and the producers of the critical raw materials for these industries.

Any discerning investors who want to benefit from future gallium price raises by buying and owning some gallium can do this through us, Strategic Metals Invest. When you purchase with us, you are purchasing from the only globally licensed industry supplier that offers this option to private investors.

It is also possible to trade gallium futures contracts in the Shanghai Metal Market (SMM).

How to Sell Gallium

Please note that online marketplaces like Amazon, eBay, and Alibaba only attract hobbyists. The only end buyers for your industrial-grade gallium are industry buyers such as Tesla, Apple, Siemens, BMW, Ford, and US-DOD. These buyers will only purchase from reputable industry suppliers with the bona-fides to provide the complete chain of custody.

No industry buyer will entertain a seller without a full chain of custody, analysis reports, purity levels, and proper storage facilities. Only because we are an industry supplier can we guarantee the fast and safe liquidation of the strategic metals of our investors.

All prices on this page last updated Jul 18 2025.