What You NEED to Know About Owning Strategic Metals (But Probably Don’t)

May 23, 2022

Why Strategic Metals Are a Better Inflation Hedge than Gold

June 28, 2022This article compares the benefits of buying and holding gold versus buying and holding strategic metals. Please note that we compare the purchase and storage of the physical assets and not investing in gold or strategic metals through shares or ETFs.

We define Strategic Metals as raw materials critical to modern technology but whose supply is limited and/or subject to disruption. These are rare earth metals and technology metals needed in high-tech products like solar panels, power plants, fibre optics, wind turbines, electric cars, jet engines, and mobile phones. However, they are considered critical by industry and also listed as critical by the US, EU, and other developing nations because of their limited supply and China’s near-monopoly in Rare Earths.

For the past few years, retail investors have been able to purchase these as investments. Those available to private investors include rare earth metals, such as dysprosium, neodymium, and terbium, and technology metals, such as gallium, hafnium, and tellurium.

We compare:

– Easy of Purchase

– Ease of Storage

– Ease of Sale / Liquidity

– Value as Hedge Against Stock Market / Crisis

– Value as (Off-shore) Store of Wealth

– Value as Inflation Hedge

– Profit Potential

– Summary

Ease of Purchase

Gold can be bought very easily and is even available over the counter from jewelers, banks, or specialist gold shops. Several reputable online businesses also specialize in selling physical bullion gold, for which they generally charge a smaller spread (the difference between what you pay and the gold spot price).

Certified Strategic Metals can only be purchased through specialist dealers. These dealers act as the middleman between the producers (most of which are in China) and the high-tech industry buyers. One of these dealers, our business partner TRADIUM Gmbh started offering Strategic Metals to private investors in 2010.

Since these rare earths and technology metals do not have a spot price like gold, a sale price must be requested from the market first. Once the buyer agrees on the price, the process of getting the assets into storage and ownership transferred is exactly the same process as buying bullion gold online (and only takes a few days from contacting us for a quote to receiving the ownership certificate). In fact, TRADIUM GmbH also offers precious metals for sale and storage.

VERDICT: Buying gold is easier if you want to buy the physical asset in person. If you are going to buy your assets, whether bullion gold or strategic metals, online or through an intermediary, then the process and duration are pretty much the same.

Ease of Storage

Depending on the amount you buy and want to keep, gold can be stored very easily. Some people prefer to store gold in their homes as they consider this to be the safest option in case of an economic collapse. As this increases the risk of home robberies, most serious investors store their gold in bank safes or specialist high-security vaults. Several companies that allow you to purchase bullion gold bars online also offer a secure storage service.

Several investors even prefer to use an off-shore storage service to protect their gold from being confiscated by their own overreaching governments in desperate need of revenue (historically, it has happened in almost all countries, so the advantage of off-shore storage is easy to see).

While Strategic Metals can technically be stored at home as well, this is not recommended as it may impact the liquidity and re-sale value. Because most buyers purchase these metals as raw materials for their production processes, they prefer to buy them from a trusted dealer who can certify their storage history and re-sell them in their original packaging. Using a professional, secure 3rd party storage facility is therefore recommended.

For example, we offer easy and secure off-shore storage of Strategic Metals you purchase through us in our business partner’s high-security bunker in Germany. Here they will be professionally stored and protected to the highest banking standards. Customers also have full risk coverage with their strategic metals insured against theft, fire, and embezzlement.

VERDICT: If you want to buy gold or strategic metals as a store of wealth at your home, then you should buy gold. However, if you purchase them as a serious longer-term investment and want to store them in a secure 3rd party vault, then the ease of storage is the same.

Ease of Sale / Liquidity

If you own a physical bullion bar, you can sell it for cash or trade it for goods over the counter or with another individual. The value you will get for it should be near the published price with the spread depending on how fast you want the cash.

If your gold is stored in a secure vault, the service provider will normally be able to sell the gold for you and deposit the funds in the currency you want within 3-5 working days.

Strategic Metals are traded on a specialized market, consisting exclusively of the producers, the processing industry who use them, and specialist brokers (like our partner TRADIUM GmbH). The price is driven by demand and supply alone.

The market is highly liquid as they are needed as a raw material in the production of so many of today’s high-tech products and industries. When using a dealer like TRADIUM GmbH to sell your Strategic Metals, they will request a price from the market for you, and if you accept, will sell your assets and deposit the funds in your account within 3 -5 business days.

VERDICT: Both Gold and Strategic Metals are highly liquid. When stored and sold by 3rd party dealers, the time to convert them to cash is pretty much the same. When you store gold yourself, it does have the advantage that it can be converted to cash over the counter if needed.

Value as Hedge Against Stock Market / Crisis

History tells us that the gold price tends to go up during stock market crashes. The recent COVID-19 pandemic is the latest example; the price of gold broke $2,000 per ounce for the first time and at some stage rose over 30% from the start of 2020.

On the other hand, the opposite is true as well. During bull stock market runs or economic recoveries, the gold price is subdued and tends to go down. Based on historical results, it is fair to assume this negative correlation with the stock market will continue.

When we look at the historical prices of Strategic Metals we don’t really see any correlation with the stock market movements. This is because the price of Strategic Metals is based on the actual supply and demand. It is the price that the processing industry is paying for them. I.e., Strategic Metals have a “real value” as opposed to “perceived value”. Because gold is denominated in dollars, the greenback can have a significant impact on the price of gold. A weaker dollar makes gold relatively less expensive for foreign buyers, and thus may lift prices.

VERDICT: Historically, gold has proven to be one of the best hedges against stock market crashes, as it tends to go up when the stock market crashes and down when the stock markets peak. However, the value of Strategic Metals is also independent of the volatile stock market movements. Based on their high demand and limited supply, their value may go up during bear AND bull stock markets.

Value as (Off-shore) Store of Wealth

Gold has been a store of value for at least 3,000 years, which is significantly longer than the longest currency in history, the British Pound Sterling, which is about 1,200 years old.

Hence based on historical results, it should be safe to assume that this trend will continue in the foreseeable future. One caveat to consider, though, is that while for most of history, gold was considered the only viable inflation and crisis-proof store of wealth, now other assets such as cryptocurrencies and strategic metals are being purchased for the same reason.

When considering the value of Strategic Metals as a store of wealth, one must understand the key difference between Strategic Metals and precious metals like gold. Where the price of gold is very much a “perceived extrinsic value”, Strategic Metals have a “real intrinsic value” based on the price the processing industry is paying for them. I.e., their price is based on supply and demand.

VERDICT: Gold has long been considered a reliable store of wealth and value, and that reputation is unlikely to change any time soon. However, it is no longer the only game in town, which might impact its longer-term perceived value. On the other hand, buying Strategic Metals means you will hold a physical asset that always will have a “real value”.

Value as Hedge Against Inflation

Gold has historically provided a hedge against inflation, and in theory, rising levels of inflation should bode well for the precious metal. This is because central governments cannot simply print more gold like they can with currencies, and as a result, its value is preserved. Historic price movements support this theory as the gold price has tended to go up during inflationary periods.

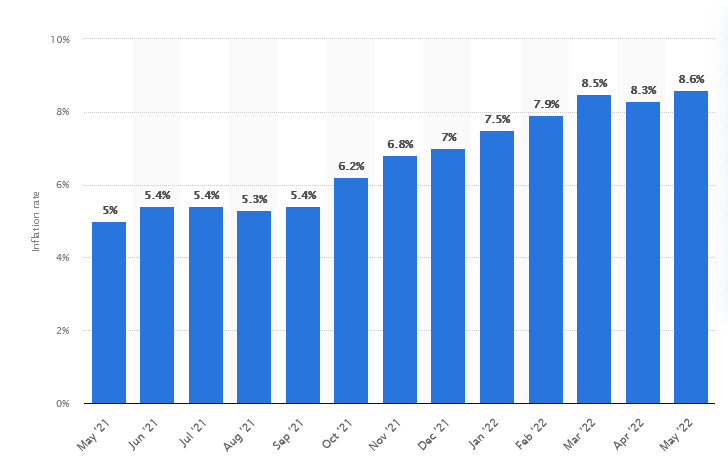

However, this theory no longer seems to hold over the past year. US inflation levels have tripled from March 2021 (2.6%) and doubled from April 2021 (4.2%) to 8.3% in April 2022. Over the same period, the gold price spiked up about 15% from March 2021, though its price currently retreated to almost the same level as a year ago.

So even with inflation levels not seen since the early 1980s, the price of gold has hardly increased (in fact, the increase is less than the level of inflation). A likely reason for this is that gold was already trading at very high levels due to the COVID-19 situation.

On the other hand, the price of Strategic Metals is driven by their own supply & demand, and not directly by inflation. However, as their supply is limited, their value is preserved. In fact, as the raw materials to in-demand products, rising prices in rare earths and technology metals can be a contributing factor to inflation.

Over the past year, we have seen significant price increases in our Strategic Metals, with several of our technology metals & rare earths doubling in value.

VERDICT: The price of gold has historically gone up with rising inflation and down again when inflation fears ease. However, the past year bucked this trend, and gold hasn’t proven to be a reliable hedge against the current high inflation levels. On the other hand, the price of Strategic Metals isn’t as closely linked to inflation, but their scarcity means their value as a physical asset is preserved in periods of high or low inflation. Hence, while both asset classes have historically proven to be an excellent hedge against inflation, Strategic Metals are the better hedge against inflation based on current socio-economic factors.

Profit Potential

Since we discuss the benefits of physically buying and holding gold or Strategic Metals, we will compare the profit potential over the medium to long term.

The price of gold has been influenced by many different factors over the past decennia. Dramatic price changes may be fuelled by factors like inflation, geopolitics, global crisis, geopolitics, and currency prices (because gold is denominated in dollars).

Looking at the historical gold price, it reached a peak in 1980 of $685/oz, after which it retreated to as low as $256/oz, and it took 26 years until it reached its previous peak again. It also took 9 years and an unprecedented global pandemic for gold to reach its 2011 peak of $1,781/oz again in 2020, recovering from as low as $1,077/oz in 2015.

As discussed above, the price of Strategic Metals is based on the actual supply and demand. The supply of most rare earths and technology metals is finite on our planet. Supply is further limited because of China’s monopoly and policy to use export limitations as a bargaining tool in trade negotiations with the US and Europe.

Demand for high-tech products using Strategic Metals is high and will only increase with a growing world population and middle-class buying the latest smartphones and gadgets. Governments worldwide, including the new Biden administration in the US, are also pushing through green policies that will boost the demand for rare earths used in the renewable energy industry even more.

VERDICT: If you perform an internet search for the gold price outlook, you will find analyst views in either direction. But since it took an unprecedented global health crisis for gold to surpass its previous 9-year-old peak before retreating again, how long will it take before it reaches the 2020 peak again? On the other hand, it is hard to argue against a continued increase in the demand for rare earths and technology metals paired with their limited finite supply. Hence we have a positive outlook for the prices of Strategic Metals in the short, medium, and long term. A quick comparison shows that the price of gold has remained the same over the past 6 months, where the prices of our 10 Strategic Metals are up 35% on average over the same period!

Summary

Any financial advisor or expert worth their salt will tell you the importance of portfolio diversification. I.e. putting all your savings in one stock or asset category is akin to gambling. Hence we’re not arguing here that gold shouldn’t be part of a balanced investment portfolio, or that it should be replaced by Strategic Metals.

However, the fact that retail investors can now buy, store, and sell scarce in-demand technology metals and rare earths with the same ease as physical gold, means there’s a strong argument that Strategic Metals should be part of any future-proof portfolio. Especially considering their undeniable positive price outlook (based on the law of supply & demand) and the option to further diversify between them.

Feel free to share your opinion with us or download our brochure with more information on how you can buy strategic metals (and gold) with us today, or check out the 5 year price movements for our rare earths and technology metals.