Dysprosium Prices

The current price of Dysprosium is $930.70 per kg.

Please note that the price provided is the retail price for private investors and is aligned with industry retail pricing. For bulk purchases, whether investment or industry, please contact us directly for a quotation.

Table: Dysprosium Historical Prices and Price Changes

| Date | Dysprosium Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Mar 06 2026 | $930.70 / kg | ||

| Jan 1 2026 | $453.90 / kg | +105.05% | |

| Jan 1 2025 | $353.10 / kg | +163.58% | +28.55% |

| Jan 1 2024 | $587.40 / kg | +58.44% | -40.49% |

| Jan 1 2023 | $653.40 / kg | +42.44% | -10.10% |

| Jan 1 2022 | $769.60 / kg | +20.93% | -15.10% |

| Jan 1 2021 | $411.10 / kg | +126.39% | +87.21% |

| Jan 1 2020 | $345.24 / kg | +169.58% | +19.08% |

| Jan 1 2019 | $238.14 / kg | +290.82% | +44.97% |

| Jan 1 2018 | $238.14 / kg | +290.82% | 0% |

Dysprosium Historical Price Movement

At today’s price of $930.70 per kg, dysprosium changed +105.05% in 2026, and gained +163.58% since 1st Jan 2025. It lost +58.44% since the start of 2024 and +42.44% since the start of 2023.

The price changed +126.39% from $411.10 per kg on Jan 1st 2021 and +169.58% since Jan 1st 2020. If we go back further than 5 years to Jan 1st 2018, when the cost of one kg dysprosium was $238.14, then the increase is +290.82%.

To get a full picture of the potential price trajectory for dysprosium, let’s explore its myriad uses and delve into which countries produce it the most. Armed with this knowledge, we can make more informed predictions about what lies ahead (jump to forecast).

Dysprosium is a chemical element with the symbol Dy and atomic number 66. It is a rare earth element with a metallic silver luster.

Dysprosium is seldom encountered as a free element in nature and is usually found in minerals such as xenotime, dysprosium-yttrium fluorite, gadolinite and euxenite. 32Dy makes up about 0.06% of the Earth’s crust.

Dysprosium Uses

Dysprosium Powder

Dysprosium is one of the most critical heavy rare earths used in modern industry. Its exceptional magnetic and thermal properties make it indispensable in high-performance technologies, especially those driving the clean-energy transition.

Permanent Magnets and Green Technologies

The majority of dysprosium produced today is used in neodymium-iron-boron (NdFeB) permanent magnets, where it significantly improves resistance to demagnetization at high temperatures. These high-strength magnets power electric vehicle motors, wind turbine generators, and advanced robotics, forming the backbone of the green-tech revolution.

Nuclear, Defense, and Aerospace

Because of its neutron-absorbing abilities, dysprosium is used as an alloying element in control rods for nuclear reactors. Its stability under extreme conditions also makes it valuable in defense, aerospace, and precision guidance systems, where reliability and heat tolerance are paramount.

Specialty and Emerging Applications

Dysprosium compounds are used in lighting, laser materials, and specialty glass production. Research is expanding its use in medical imaging and diagnostic lasers, while new energy-efficient technologies continue to open additional commercial pathways.

Strategic Importance

As one of the key “energy transition metals,” dysprosium is now considered essential to the global move toward decarbonisation. The European Union, the United States, and Japan all list it as a critical raw material, citing its irreplaceable role in clean-energy manufacturing and its highly concentrated supply chain in China.

Demand for dysprosium is expected to grow steadily for decades, with analysts projecting that consumption for magnet applications alone will not peak before the 2040s, underscoring its long-term strategic importance.

Where is Dysprosium Produced?

Dysprosium occurs mainly in ion-adsorption clays, which are especially rich in the heavy rare earth elements. The highest-grade deposits are found in southern China, particularly in Jiangxi Province, where clays can contain significantly higher concentrations of dysprosium than monazite or bastnäsite ores found elsewhere.

Today, China controls over 90% of global dysprosium production, not only through mining but, more importantly, through its near-monopoly on refining and separation capacity, which remains the real bottleneck for heavy rare earths.

A large share of the raw ore processed in China originates from Myanmar, whose intermittent mine closures and border disruptions frequently tighten supply and contribute to price volatility.

Outside of China, production remains limited. Smaller volumes come from Australia, Malaysia, and Russia, while Western governments are now investing heavily in projects aimed at diversifying supply. Notably, Lynas Rare Earths has become the first commercial producer of heavy rare earths outside China, though global capacity remains far from meeting projected long-term demand.

What Factors Determine the Price of Dysprosium?

Dysprosium prices are driven by a combination of industrial demand, supply concentration, geopolitical risk, and technological trends.

1. Demand from Permanent Magnets and Green Technologies

The single biggest driver of dysprosium demand is its use in high-performance NdFeB permanent magnets, which power:

electric vehicle motors

wind turbine generators

robotics and automation

industrial motors

As nations accelerate toward low-carbon economies, magnet demand continues to rise. Analysts expect consumption for energy-transition metals like dysprosium to grow steadily into the 2040s, with no peak in sight.

2. Highly Concentrated Supply

While rare earths are relatively abundant in the earth’s crust, economically viable deposits of heavy rare earths like dysprosium are scarce. Extraction is costly, refining is complex, and over 90% of global separation capacity sits in China.

This concentration means dysprosium prices are influenced not just by mining output but by:

Chinese export restrictions

refining bottlenecks

production quotas

environmental enforcement campaigns

disruptions at Myanmar’s ion-adsorption clay mines

3. Geopolitical and Trade Dynamics

Events such as export controls, trade disputes, or border closures can have immediate price impacts, particularly because Western manufacturers have limited alternatives to Chinese supply. Recent policy shifts have shown that heavy rare earth markets are increasingly treated as strategic assets rather than simple industrial commodities.

4. Slow Supply Growth vs. Rapid Technology Adoption

Developing new rare earth mines and separation facilities takes years, often more than a decade. Meanwhile, technological adoption (EVs, wind) grows far more quickly. This mismatch frequently pushes the market into structural deficits, tightening supply and supporting higher prices.

5. Slow and Fragmented Price Reporting

The global rare earth market remains relatively opaque, with spot indices often reflecting only a small share of actual industrial trading activity. Published prices tend to lag behind real-world buyback markets, where manufacturers and refiners may adjust offers much more quickly in response to immediate needs or supply shocks.

To help private investors navigate this, we publish current dysprosium prices directly on our website, offering clear, up-to-date guidance in a market where reliable pricing is not always readily available.

Even in periods when new sales are paused, movements in the industrial buyback market can diverge significantly from published spot prices. This is why, for example, our December 2025 buyback price of $780/kg for existing clients is substantially higher than many published indices: it reflects true industrial demand in real time, rather than delayed spot-market reporting.

Summary

Dysprosium prices are shaped by a unique combination of rising long-term demand, highly concentrated supply, geopolitical leverage, and slow supply-chain development. This environment creates both opportunities and volatility, especially during periods of supply constraint.

Dysprosium Price Forecast

1. Global Market Outlook

The global dysprosium market continues to expand:

Valued at USD 540 million in 2024, it is projected to reach USD 786 million by 2030, a CAGR of 6.6%, according to Grand View Research’s dysprosium market outlook.

Longer-term forecasts point to growth from USD 1.0 billion in 2024 to USD 1.75 billion by 2035, reflecting a 5.2% CAGR.

Magnet demand, while no longer growing at double-digit rates, is expected to advance at a steady ~5% annually in 2025, fuelled by electric mobility and renewable energy technologies.

2. Geopolitics & Supply Chain Dynamics

China’s grip on the rare earths sector remains the defining factor:

In April 2025, Beijing imposed new rare earth export restrictions on seven heavy rare earths, including dysprosium. Exporters were required to secure special licenses and quotas, causing severe disruption to global supply chains.

The immediate impact: European dysprosium oxide prices nearly tripled within weeks, highlighting the market’s vulnerability to policy shifts.

Although China later suspended restrictions temporarily and agreed to a limited “green channel” for U.S. firms, the episode underscored Beijing’s willingness to weaponize its rare earth dominance.

3. Supply Diversification & Western Response

Efforts are underway to break this dependence:

Lynas Rare Earths has become the first company outside China to produce heavy rare earths, including dysprosium, a milestone in diversifying supply.

The U.S. government is exploring $2 billion in CHIPS Act funding to strengthen domestic rare-earth mining and processing capabilities.

These moves represent progress, but building new supply chains will take years—ensuring the market remains tight and volatile in the near term.

4. Price Forecast Scenarios

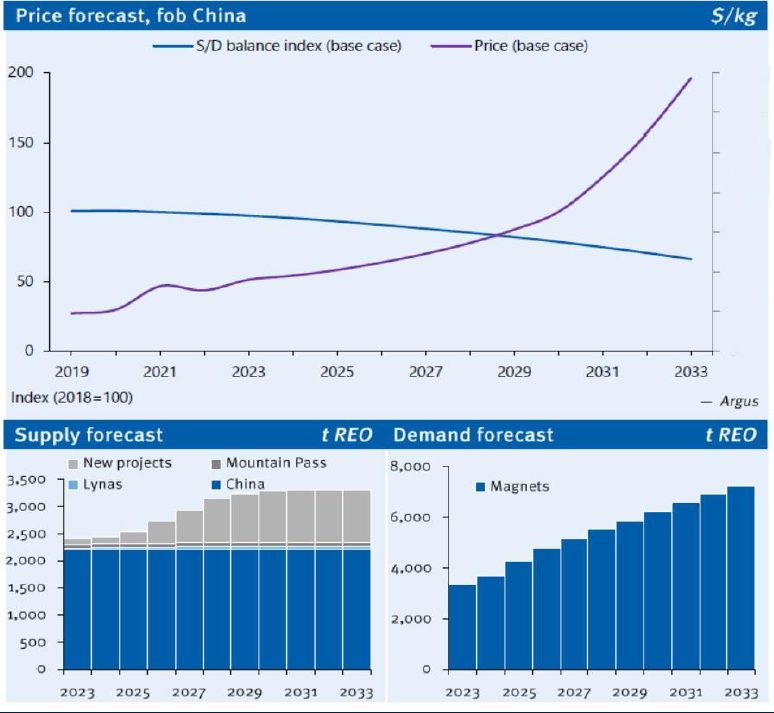

Industry analysts, including Argus Media, outline two possible paths for dysprosium over the coming decade (see graphic below):

Base case: Dysprosium oxide could climb to around USD 1,100/kg by 2034, representing a 340% increase from today’s levels.

Premium case: In a scenario where pricing decouples from Chinese norms and strategic premiums are applied, values could rise as high as USD 1,400/kg—a gain of over 450%.

For context, the current retail price is USD 453.90/kg (as of August 26, 2025).

Why This Matters

Dysprosium is no longer just a rare earth—it’s a geopolitical cudgel, a green-tech lynchpin, and a gold-lined opportunity. With Chinese leverage at play and the West gearing up for alternatives, investors who act now may be positioning themselves not only for financial returns but also for exposure to one of the most strategically vital resources of the 21st century.

Please note that due to the current shortages, we’ve temporarily paused the sale of dysprosium to new clients, offering instead a $780/kg buyback option to existing clients. That’s an eye-popping gain—approximately +121% since January 1 (start-of-year price: USD 353.10/kg).

How to Buy Dysprosium

Industry-grade dysprosium powder is usually sold at minimum 99.5% purity, priced in USD, and the weight unit is per kilogram. Safe storage is essential because, like many powders, dysprosium may constitute an explosion hazard when mixed with air and an ignition source is present.

Corporate buyers such as Tesla, BMW, Ford, and Mercedes use well-established metal dealers to buy industry-grade dysprosium. Renowned metals dealers, such as ourselves, act as key intermediaries between the high-tech industries and the producers of the critical rare earth elements needed by these industries.

Unless you purchase from a reputable dealer (e.g. if you buy on Amazon, Alibaba, or eBay), there’s no guarantee of purity and no possibility of liquidation to anyone other than hobbyists.

Any discerning investors who want to benefit from future price increases by purchasing and owning some dysprosium can do this through us. By doing so, you are buying from the only globally licensed industry supplier offering this option to private investors.

Dysprosium futures contracts can also be traded in the Shanghai Metal Market (SMM).

How to Sell Dysprosium

Please note that the only end buyers for your industrial-grade dysprosium are industry buyers such as General Motors, Honda, Tesla, Apple, and First Solar. These buyers will only buy from established industry suppliers with documentary evidence of the complete chain of custody. They don’t buy from the likes of eBay, Alibaba, or Amazon.

No industry buyer will transact with a seller that cannot provide the entire chain of custody documentation, analysis & purity reports, and proper storage facilities. We guarantee the fast and safe liquidation of the rare earth elements of our investors because we’re such an industry supplier.

All prices on this page last updated Mar 06 2026.