Understanding the Volatility of Strategic Metals – First Principles Explained

November 29, 2023

Weekly News Review Jan 15-21 2024

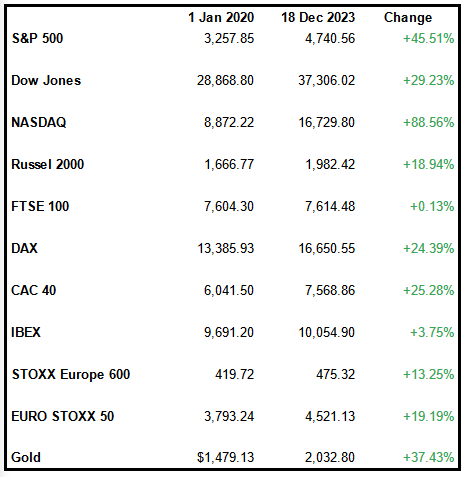

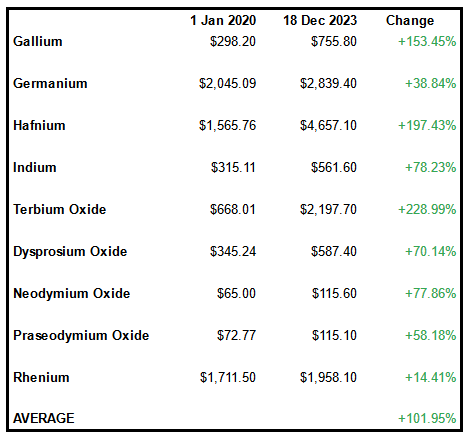

January 22, 2024As we reported during the year, we had unprecedented price decreases from the beginning of the year until about June/July. Yet, strategic metals have still outperformed all major stock indices and gold since 2020 (see tables at the bottom of this email).

Since August 1st, China has been restricting the export of Gallium and Germanium, and prices have steadily increased. Since November, China has been restricting the export of graphite.

The latest news is that as of 4 days ago, Friday, December 1st, China is also restricting the exports of rare earths. We had known this was coming; however, a development behind this is ominous and manifest.

For the first time, the Chinese Ministry of State Security (the CIA, Chinese Intelligence Agency) lists strategic metals as a national security priority.

The agency vows to protect supply chains against foreign meddling and protect Chinese overseas projects. This was reported in the South China Morning Post last week.

The Ministry argues that the critical minerals sphere has become a new battleground between global superpowers.

We have had the warning shots across the bow, and now China is ushering in a new era of resource nationalism.

This is likely a wink to the recent trade dispute with the United States surrounding the export ban on advanced semiconductors, which was initially met by China with export restrictions on Gallium and Germanium.

However, the inclusion of rare earths, the extension to include critical minerals projects overseas, and the Chinese intelligence agencies’ vow to protect projects overseas are further evidence of China’s intention to completely control the global supply chain.

As a result, we are predicting shortages of rare earths and technology metals as early as 2024. Initially, we had anticipated bottlenecks and supply disruption beginning in 2025 and peaking around 2030.

There have been occasional shortages in the past; however, the industries affected are now much more critical to all nations’ economies (e.g., electric cars, technology, aerospace, and energy transition). The expected impact is correspondingly more significant.

Moreover, it’s not just individual resources that could become scarce, but dozens simultaneously.

Couple this with a possible further escalation of tensions between the West and China, and we are seeing a perfect storm on the horizon earlier than anticipated.

Management consultancy firm Deloitte has warned of the coming scarcity in its annual manufacturing industry outlook published just last week:

Deloitte Manufacturing Industry Outlook

Industry experts are predicting these further efforts to control critical minerals could give worldwide demands for diversifying supply chains a tailwind.

The prices are about as low as they are ever likely to be, and we strongly suggest that if you plan to take a position or even a second, third, or fourth position, now is the time.

On the industry side, we are happy to report that Tradium’s turnover has already reached $150 million for the year. This is quite remarkable, as Tradium first passed the threshold of $100 million in turnover in 2022.

As a result, Tradium and Metlock are accelerating the construction of the second storage facility in Frankfurt.

The land has already been purchased, and the construction plans have now been accelerated. The current facility has two storage levels below ground and is nearing completion of a third level above ground.

Originally, it was a bunker in WWII. Now, we have a level above ground for storage and an atrium featuring offices and a meeting room with an adjacent kitchen so visiting clients can be hosted for lunch during or after a visit. All interior work is complete, and a new above-ground level will be launched once the exterior work is done.

The new facility will take 3 to 5 years to build and open. It is also located in Frankfurt and will also be a duty-free zone. Once it opens, it will be used primarily to store our industry clients’ raw materials and our inventory. The current facility will then house all private investors’ raw materials, which means we can triple our capacity for private investors.

That’s all we have for now.

Many thanks, and we wish you and yours a wonderful holiday season.

Strategic Metals Performance Since Jan 1st, 2020:

Stock & Gold Performance Since Jan 1st, 2020: