Gallium Prices

The current price of Gallium is $2,101.60 per kg.

Please note that the price provided is the retail price for private investors and is aligned with industry retail pricing. For bulk purchases, whether investment or industry, please contact us directly for a quotation.

Table: Gallium Historical Prices and Price Changes

| Date | Gallium Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Feb 17 2026 | $2,101.60 / kg | ||

| Jan 1 2026 | $1,722.60 / kg | +22.00% | |

| Jan 1 2025 | $940.50 / kg | +123.46% | +83.16% |

| Jan 1 2024 | $755.80 / kg | +178.06% | +23.20% |

| Jan 1 2023 | $640.80 / kg | +227.97% | +17.95% |

| Jan 1 2022 | $648.80 / kg | +223.92% | -1.23% |

| Jan 1 2021 | $422.70 / kg | +397.18% | +53.49% |

| Jan 1 2020 | $298.20 / kg | +604.76% | +41.75% |

| Jan 1 2019 | $355.85 / kg | +490.59% | -16.20% |

| Jan 1 2018 | $274.37 / kg | +665.97% | +29.70% |

Gallium Historical Price Movement

At today’s price of $2,101.60 per kg, gallium changed +22.00% since Jan 1st 2026, and +123.46% since the start of last year. It is up +397.18% from its price of $422.70 per kg on Jan 1st 2021 and has increased +604.76% since Jan 1st 2020 (in comparison, the S&P 500 is up +110.12% over the same period). If we go back to Jan 1st 2018, when the cost of gallium was $274.37 per kg, then the increase is +665.97%.

Gallium is a chemical element with the symbol Ga and atomic number 31. It is a soft, silvery metal, and elemental gallium melts just above room temperature at 29.76 °C (85.57°F).

To make an educated forecast on the price of gallium, let’s take a closer look at the uses of gallium, its production, and the key factors that will drive the cost of gallium in the future (jump to our forecast).

Gallium Uses

Gallium

Gallium’s extraordinary physical and chemical properties make it essential to the modern tech economy, especially in semiconductors, power electronics, optoelectronics, and clean energy systems.

Semiconductors & Power Electronics:

Gallium arsenide (GaAs) and gallium nitride (GaN) are two of its most critical compounds.GaAs is widely used in high-frequency components, such as 5G base stations, radar, and satellite communications.

GaN has become the dominant growth driver, enabling next-gen power converters, EV fast chargers, and military RF systems. It’s prized for its energy efficiency and ability to operate at high temperatures and voltages.

Solar & Renewable Energy:

Gallium is a key ingredient in thin-film photovoltaic cells, offering higher efficiency and flexibility than traditional silicon-based panels. Demand here is accelerating as governments expand solar capacity.LEDs, Lasers & Displays:

GaN is also the backbone of modern LED lighting, smartphone displays, laser diodes, and AMOLED technologies, all of which are seeing mass global adoption.Defense, Aerospace & Nuclear:

Gallium alloys are used in specialized applications like radiation-resistant components, neutron-absorbing materials, and high-performance thermal pastes. Its non-toxicity and thermal stability make it a safer alternative to mercury in medical and nuclear applications.

Where is Gallium Produced?

Gallium isn’t mined directly — it’s extracted as a by-product during the refining of bauxite (for aluminum) and zinc ores. While a handful of countries produce raw gallium, China dominates the global supply chain, accounting for over 95% of worldwide production.

The top producers are:

🇨🇳 China: by far the largest supplier, both of raw and refined gallium

🇩🇪 Germany: a key secondary producer in Europe

🇰🇿 Kazakhstan: an emerging source via zinc processing

China’s control doesn’t stop at production. It also leads in refining capacity, making it the central player from raw extraction to finished high-purity gallium, a major strategic chokepoint for the West.

What Factors Determine the Price of Gallium?

As with all metals, supply and demand ultimately set the price, but in gallium’s case, those forces are supercharged by geopolitics and rapid technological change.

On the demand side, gallium is indispensable for:

Power electronics (GaN chips in EVs and fast chargers)

5G infrastructure (GaAs components)

Thin-film solar panels

LEDs, lasers, and defense systems

As global investment surges into electrification, AI, and renewables, gallium consumption is accelerating in lockstep.

Supply, however, remains highly concentrated and fragile. Gallium is not mined directly; it’s extracted as a by-product of aluminum and zinc refining. And over 95% of global gallium output comes from China, which not only produces the raw material but also controls the downstream refining and high-purity conversion.

This creates an inherently unstable market. Even minor shifts in Chinese policy, such as export bans, license restrictions, or stepped-up anti-smuggling enforcement (as seen in 2025), can trigger significant price movements globally.

In short, gallium’s price is shaped not only by what industries need, but by what China allows. For investors, understanding both the industrial fundamentals and the geopolitical backdrop is key to anticipating where prices may go next.

Gallium Price Forecast

At a glance

Price pulse: Gallium gained 83.16% in 2025, after gaining 23.20% in 2024 and 17.95% in 2023 (see live table above).

- Policy & geopolitics: China’s December 2024 gallium export ban to the U.S. set a higher “security premium” that’s still echoing through 2025.

- Critical status (EU + U.S.): Gallium remains on the EU Critical Raw Materials list (CRMA now in force) and is identified by the U.S. Department of Energy as a “critical material for energy.”

What changed in 2025

Ban bites: The Dec-2024 China-to-U.S. gallium export ban tightened Western availability into 2025, supporting a firmer floor under prices and widening Western premiums.

- EU execution: The CRMA moved from headlines to implementation, with EU documents underlining high import reliance and demand growth across semiconductors, charging infrastructure, 5G, and renewables.

- Narrative shift: Policymakers are talking less about “if” supply chains diversify and more about “how fast”; but new Western tonnage remains very modest vs. need in the near term.

What this means for Gallium

Higher floor, choppy ceiling: Security-of-supply pricing is here. Pullbacks can happen during electronics downcycles, but trade policy keeps the bid replenished.

- Time lag on new supply: Western recovery (alumina/zinc by-product) and recycling are advancing, yet scale takes many years, not quarters.

Price drivers tilting upward

Geopolitics-as-mechanism: A live ban, tighter licensing, and scrutiny of backchannels constrain Western supply.

- Semiconductors and advanced electronics: Gallium-based compounds like GaN and GaAs underpin next-generation semiconductors used in power electronics and RF systems, from fast chargers and EV inverters to 5G networks and defense radar. These are all key engines of structural demand growth.

- Policy pull (EU & U.S.): The CRMA’s 2030 processing/recycling benchmarks and U.S. “critical materials” framing both support investment signals and strategic stockpiles.

Potential headwinds to watch

Macro softness in electronics (short-cycle demand risk).

- Chinese pricing tactics via domestic easing or third-country leakage can narrow Western premiums episodically.

6–12 month gallium forecast view

Bias: Moderately bullish

Rationale: YTD momentum (+~32%) plus constrained Western gallium availability post-ban keeps support under prices; CRMA execution and U.S. “critical” designation buoy sentiment even if volumes lag.

12–24 month forecast view

Bias: Moderately bullish (with volatility)

Rationale:

Tightness persists as Western supply adds headlines faster than tonnage; periodic policy shocks (export rules, quotas) can spark spikes.

Demand mix improves (power electronics, 5G, renewables) while EU/U.S. policy keeps strategic stockpile talk alive.

- Western gallium recycling and recovery projects continue to advance slowly, a delay that, paradoxically, helps maintain current price strength.

3–5 year forecast view

Bias: Constructively bullish

Rationale:

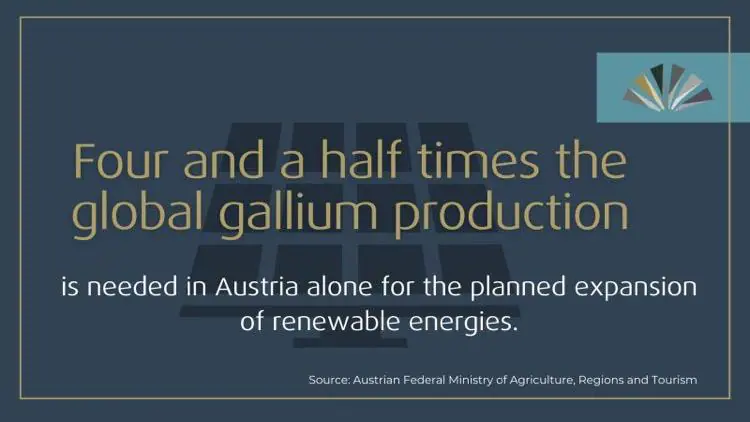

Structural demand: EU documents project robust growth; by mid-century (around 2050), EU demand alone could exceed today’s global supply if trajectories hold, underscoring the risk of chronic tightness.

China’s tech moat: Huawei and China’s broader GaN ecosystem remain formidable (thousands of GaN-related patents), implying strong domestic pull on gallium.

Diversification arc: Expect more alumina/zinc by-product recovery and recycling in the West, but full de-risking takes multiple investment cycles.

Why physical Gallium fits the Strategic Metals Invest playbook

Critical status on both sides of the Atlantic: EU CRMA + U.S. DOE “critical materials” framing cement gallium’s strategic importance, i.e., policy tailwinds that reward scarcity.

Concentrated refining + live restrictions: One dominant refiner (China) and an active export ban create episodic price gaps and persistent Western premia.

- Human-capital bottleneck: Rebuilding non-China capacity isn’t just about capex; it’s about talent. While China graduates 200 metallurgists a week, the U.S. produces the same number annually. With over 400,000 people employed in China’s rare earths and technology metals sectors compared to just 400 in the U.S., rebuilding expertise and infrastructure outside of China could take a generation or more.

How to Buy Gallium

Gallium is sold at 99.99 percent purity, priced in USD, and the weight unit is per kilogram. Anyone, such as hobbyists, can buy small amounts of gallium on Amazon, Alibaba, or eBay. However, there is no guarantee of purity and no possibility of liquidation to anyone other than other hobbyists.

Corporate buyers such as LG, Nokia, Qualcomm, and Sony use well-established metal dealers to purchase industry-grade gallium. Reputable metals dealers, such as ourselves, act as key intermediaries between the high-tech industries and the producers of the critical raw materials for these industries.

Any discerning investors who want to benefit from future gallium price raises by buying and owning some gallium can do this through us, Strategic Metals Invest. When you purchase with us, you are purchasing from the only globally licensed industry supplier that offers this option to private investors.

It is also possible to trade gallium futures contracts in the Shanghai Metal Market (SMM).

How to Sell Gallium

Please note that online marketplaces like Amazon, eBay, and Alibaba only attract hobbyists. The only end buyers for your industrial-grade gallium are industry buyers such as Tesla, Apple, Siemens, BMW, Ford, and US-DOD. These buyers will only purchase from reputable industry suppliers with the bona-fides to provide the complete chain of custody.

No industry buyer will entertain a seller without a full chain of custody, analysis reports, purity levels, and proper storage facilities. Only because we are an industry supplier can we guarantee the fast and safe liquidation of the strategic metals of our investors.

All prices on this page last updated Feb 17 2026.