Weekly News Review May 5 – May 11 2025

May 11, 2025

Weekly News Review May 12 – May 18 2025

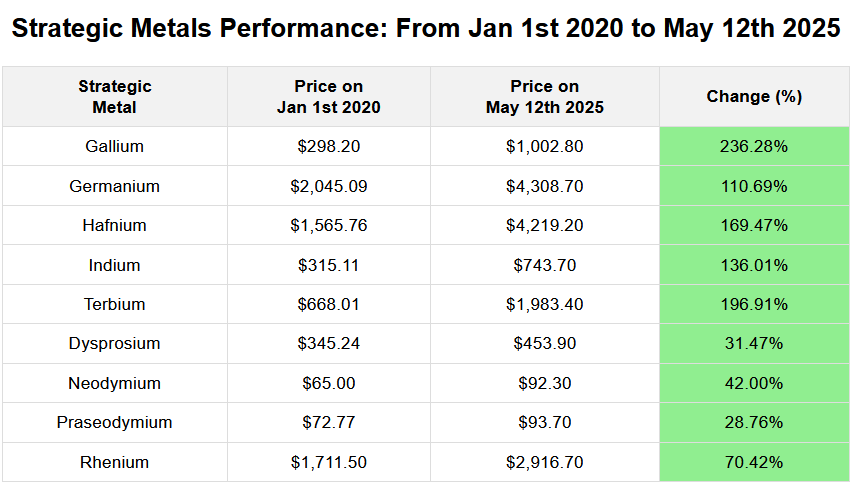

May 18, 2025Historically, owning strategic metals as physical assets has proven to be profitable (see table below); however, there are some unique characteristics to this winning investment strategy.

Owning strategic metals is, in many ways, similar to owning precious metals (which we also offer), insofar as the private investor physically owns the underlying asset. However, there are some important safety issues that all potential clients should be aware of, which make the decision to own strategic metals a little more strategic, shall we say.

This week, we will discuss and explore the factors that influence the price volatility of these valuable commodities.

Between soaring and plummeting, the prices of strategic metals are often subject to strong fluctuations. We explain the global developments behind these fluctuations and what they mean for buyers of tangible assets.

These five factors determine the pricing of commodities.

GEO-POLITICAL DECISIONS AND LEVERAGING:

Government measures can directly influence commodity prices. One example is China, where electromobility is being driven by high subsidies. Rare earths are used in the permanent magnets of electric motors. To cover the expected increase in demand for these raw materials, the Chinese government increased the production quotas for rare earths by 19 per cent at its peak since 2023. The country determines the amount of rare earths that individual companies have to produce through so-called production quotas. In other countries, such as Germany, the demand for e-cars falls short of expectations. This was partly due to government purchase incentives, which were only temporary. The slowdown in the growth of e-mobility is seen as one, albeit not the decisive reason, for this factor at the current comparatively low price level for rare earths.

Another example of how political decisions can influence prices is the various export requirements from China, including for Germanium or gallium. The People’s Republic justifies these regulations with national security concerns. In the summer of 2023, the country introduced export restrictions for the two technology metals. As a result, their Prices rose sharply in some cases, and continue to do so today.

NEW TECHNOLOGIES:

Demand for certain raw materials can skyrocket when they are needed for new technologies. This is particularly the case in emerging areas such as artificial intelligence. Gallium arsenide, for example, is required for high-performance chips. Powerful computing chips have become so central that they have become part of a trade conflict between the USA and China that has been ongoing for years. In addition, rare earths and a range of other raw materials are necessary for producing industrial robots. The latter are increasingly taking on physically strenuous, monotonous tasks or require constant high precision. The demand for these future technologies will likely increase and drive up the prices of individual raw materials.

SUPPLY DISRUPTION AND SUPPLY BOTTLENECKS:

Global trade routes are the backbone of the supply of raw materials. But they are susceptible to crises and conflicts. A current example: due to the Attacks by Houthi rebels in the Red Sea, for over a year now, ships have either taken a diversion via the southern tip of Africa, with longer transport routes and additional fuel costs. Or they pay significantly higher insurance premiums to pass through the area, despite the danger, and not be left holding the bag for possible damage. Both are very cost-intensive and lead to a shortage of goods at the destinations. These disruptions to supply chains and rising costs could impact commodity prices in the medium term, according to Frank Meier, who is assessing the current situation.

STRATEGIC STOCKPILING:

The industry is building up its stocks of sought-after raw materials to secure its long-term future. This was the case in Summer 2024 at Rhenium, for example. This is the case, for example, for aircraft turbine blades or industrial catalytic converters. Some companies replenished their stocks, and others followed suit. This chain reaction led to a Short-term price increase of up to 24 percent within a few weeks.

Another example: After the coronavirus pandemic, many companies in the air transport sector have reorganised themselves with raw materials such as hafnium, after being reluctant to buy due to the significantly lower volume of flights. The metal ensures that turbines are more resistant to heat and corrosion. The boom in demand in 2023 consequently caused the price of hafnium to skyrocket: In October 2023, the value was a complete 120 percent above the 2012 level.

SECURITY SITUATION:

The number of conflicts and wars is increasing, and more and more nations are arming themselves. In Europe, the focus has also been on defence for some time now. With the “REARM Europe“, 800 billion euros will be invested in security and resilience. The plan aims to enhance military armament and security infrastructure in Europe, both of which increase demand for individual metals. In the case of Germanium, which is indispensable in military equipment such as night-vision goggles, the increased demand has already been reflected in higher prices since summer 2024. In March 2025, the value was 37 percent above the previous year’s. The export restrictions for Germanium mentioned under “Political decisions” also impacted pricing.

We expect more countries to increase their defence spending, which could give the market even more momentum.

Developments in commodity markets show this. Volatile prices are often the result of global changes and political decisions. This dynamic can be an opportunity for buyers of strategic metals as tangible assets.

Next week, we will take a close look at the seven characteristics you may not know that you absolutely should know before purchasing strategic metals as physical assets.