End Of Year Summary 2023

December 20, 2023

Market Insight on China’s Gallium and Germanium Export Ban

January 26, 2024Strategic metals took center stage this week at the World Economic Forum in Davos, Switzerland.

The consensus is that countries worldwide are focusing into the sector, from India forging ahead with lithium mining and Bolivia eyeing rare earths to the United Kingdom issuing a plan to bolster critical supply chains.

So, first, let’s look at the World Economic Forum.

Critical minerals and how their supply can be secured against rising demand and increasing geopolitical tensions were heavily on the agenda on the third day of the World Economic Forum in Davos.

One of the important points of the panel moderated by Jason Bordoff, an energy policy expert and professor at Columbia University, was that the mining industry needs more capital.

The industry is suffering from underinvestment, said Benedikt Sobotka, CEO of Eurasian Resources Group.

His company supplies essential raw materials for the energy transition. Sobotka sees a “perfect storm” brewing due to rising demand but insufficient supply from the industry. He attributes the sector’s lack of capital to the fact that investors know too little about mining and are not interested in it.

The industry is needed but not necessarily wanted, added Leila Benali, Moroccan Minister for the Energy Transition.

Another factor repeatedly referred to and cited as a challenge is a shortage of skilled workers.

By 2029, more than half of the 200,000-strong workforce in the US mining industry will retire, and they are not being replaced. In the 1980’s there were 28 universities in the US graduating degrees in critical minerals, today there are only 14. Human capital and engineering expertise no longer exist in the US and EU.

In the UK, plans are in motion to boost critical supply chains.

To tackle supply chain disruption risks and increase resilience against challenges like climate change, geopolitical tensions, and trade protectionism, the British government published a Critical Imports and Supply Chains Strategy this week.

One of the central objectives of the strategy is a better collaboration between the industry, government, and academia to identify and address possible risks before they affect the British economy.

Big news from South Korea as confirmation comes in to forge ahead with a 470 billion dollar plan to build the world’s largest chip factories, to be named mega-campuses.

South Korean President Yoon Suk Yeol unveiled an updated plan to build the world’s most extensive chipmaking hub south of Seoul’s capital.

Part of the ambitious plan is a staggering sum of $470 billion in investments from the private sector. Set to be completed in 2047, the ambitious plan envisions leading chip makers, including Samsung and SK Hynix, to funnel capital into building 13 new chip plants and three research facilities on top of 21 existing facilities.

This would effectively double the number of chip-producing plants in the province, making it the largest cluster in the world with an expected output of 7.7 million 200-millimeter-equivalent wafers per month.

India and Bolivia are making progress on mining critical minerals.

While the Bolivian government announced plans to mine rare earths, India is forging ahead with lithium extraction on home soil and has acquired lithium blocks in Argentina.

…. and now to China. Those of you following our news cycle will already know that you cannot have a conversation and probably even write a sentence about rare earths without mentioning China.

CHINA’S EXPORTS OF RARE EARTHS RISE YEAR-ON-YEAR –

In 2023, China exported 7.3% more rare earths than in the previous year: exports rose from 48,727 to 52,306 tons, according to data from the customs administration.

The People’s Republic also significantly increased its production quotas for this group of critical raw materials last year.

Incredibly, China produced more solar panels in 2023 than the entire world did in 2022.

China’s vertical supply chain integration continues, particularly regarding the energy transition, electric cars, solar and wind.

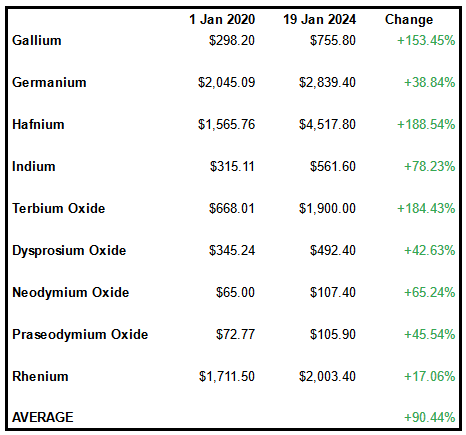

As we write, China has been restricting the export of Gallium and Germanium since August last year. Naturally, prices are rising as a result. Graphite was added in November, and all rare earth elements were added to the list in December, as well as a ban on the technologies involved in the most crucial part, the processing and refining of rare earths.

GLOBAL EV SALES INCREASED BY 31 PERCENT IN 2023 –

Reuters reported that worldwide sales of electric vehicles increased by 31 per cent in 2023, down from a 60 per cent upsurge in 2022, citing the market research firm Rho Motion.

Despite the decline, the number follows Rho Motion’s prediction of a 30 per cent yearly increase. The company expects this trend to continue and forecasts a 25 to 30 per cent growth in 2024.

The past year ended with a record monthly volume of 1.5 million EVs sold in December, totalling 13.6 million sales over the year.

We are also seeing the emergence of Chinese electric car maker BYD. It is predicted that BYD will outsell Tesla for the first time in the first quarter of 2024, making BYD the number 1 electric car maker in the world, also occuring for the first time.

Again, this is further evidence of China’s continued growth up the value chain.

NORWEGIAN PARLIAMENT ALLOWS DEEP-SEA MINING –

This week, parliament approved the government’s proposal to open up an area in the North Atlantic to explore and extract mineral resources.

However, the impact on the environment has not yet been fully clarified, and there is also the threat of geopolitical tensions as Russia disputes the Scandinavian country’s exclusive claims to the area.

Meanwhile, in the Middle East, Saudi Arabia has begun to diversify.

SAUDI ARABIA INVESTS $182 MILLION IN RARE EARTH EXPLORATION –

Saudi Arabia plans to invest 182 million dollars in the exploration of critical minerals to diversify its economy, mainly based on oil and gas exports.

The Gulf state recently raised the estimated value of its untapped mineral potential by 90 per cent to $2.5 trillion, based partly on rare earth discoveries.

At the Future Minerals Forum, which took place in the Arabian capital of Riyadh, it was also decided to strengthen cooperation in the rare earths sector with the Democratic Republic of the Congo, Egypt, Morocco, and Russia.

That’s it for this week.

Strategic Metals Performance Since Jan 1st, 2020: