Bismuth Prices

The current price of Bismuth is $61.10 per kg.

Please note that the price provided above is the retail price for private investors and is aligned with industry retail pricing. For bulk bismuth purchases, whether investment or industry, please contact us directly for a quotation.

Bismuth Historical Price Movement

Bismuth has only recently become available for purchase by private investors. It is important to note that bismuth prices have traditionally been influenced by a concentrated supply base, limited spot-market liquidity, and evolving regulatory factors. In recent years, export restrictions and supply-side interventions, particularly from China, have increased price sensitivity and volatility in the bismuth market, bringing the metal more clearly onto the radar of strategic metal investors.

To better understand bismuth’s future price potential, let’s explore its key applications and the sources of global production (click here to jump to the forecast).

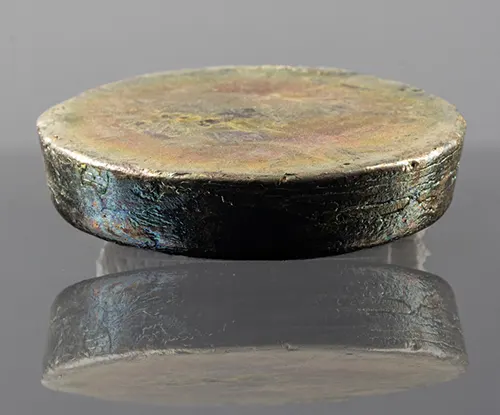

Bismuth is a technology metal primarily produced as a by-product of refining lead, copper, tin, and tungsten. It is characterised by its low toxicity, brittle crystalline structure, and distinctive metallic lustre, and is typically silvery-white with a slight pink hue. Bismuth is identified by the chemical symbol Bi and atomic number 83.

Bismuth Uses

The applications of bismuth are closely linked to its unique physical and chemical properties, particularly its low toxicity, high density, and distinctive crystalline structure. These characteristics make bismuth valuable across a range of industrial, medical, and technological applications.

One of the most important uses of bismuth is in pharmaceuticals and medical products. Bismuth compounds are widely used in gastrointestinal medicines, cosmetics, and medical devices due to their antibacterial properties and relative safety compared with other heavy metals.

Bismuth also plays a growing role in metallurgy, where it is added to steel, aluminium, and copper alloys to improve machinability and performance. In these applications, bismuth is increasingly used as an environmentally friendly substitute for lead, particularly in free-machining steels and brass used in automotive and industrial components.

In the electronics and materials industries, bismuth is used in low-melting-point alloys, solders, and fusible materials. These alloys are critical for applications requiring precise temperature control, including safety devices, fire detection systems, and electronic components.

Beyond these established uses, bismuth is gaining importance in emerging technologies, including thermoelectric materials, advanced battery chemistries, and lead-free electronic applications. As regulatory pressure to reduce toxic materials continues to increase, bismuth’s role as a strategic alternative metal is becoming increasingly relevant.

Where is Bismuth Produced?

Bismuth occurs in low concentrations and does not typically form standalone deposits. Instead, it is produced primarily as a by-product of lead, copper, tin, and tungsten refining. As a result, bismuth supply is closely linked to the production levels of these base metals rather than to demand for bismuth itself.

Global bismuth production is relatively limited, with annual output estimated at around 16,000 tonnes. The majority of this production comes from China, which dominates both mining output and downstream refining capacity. Additional quantities are produced in countries with established base-metal industries, including Laos, South Korea, and Japan, as well as more limited volumes from Kazakhstan, Bolivia, and parts of Europe.

Because bismuth production is dependent on base-metal refining and concentrated processing infrastructure, supply cannot be expanded quickly in response to rising demand. This structural characteristic plays an important role in shaping bismuth availability and contributes to periodic price sensitivity when supply conditions tighten.

What Factors Determine the Price of Bismuth?

Like other commodities, bismuth prices are fundamentally driven by the balance between supply and demand.

Bismuth has become increasingly important to a range of industries. Growing demand for end products in sectors such as automotive manufacturing, electronics, medical applications, and environmentally regulated industries directly influences demand for this specialised metal.

On the supply side, bismuth is considered constrained due to its production model and concentrated refining base. It occurs in relatively low concentrations and is produced primarily as a by-product of base-metal refining, particularly lead and copper. This means bismuth supply cannot be expanded independently and is largely determined by broader base-metal production levels, making the market sensitive to changes in industrial demand, regulatory developments, and supply-side disruptions.

Bismuth Price Forecast

At a glance

Bismuth sits among a small group of minor metals whose pricing is shaped less by trading activity and more by structural supply constraints, regulatory influence, and steady industrial demand. Unlike exchange-traded commodities, bismuth is not characterised by continuous price discovery but by periodic adjustments reflecting changes in availability, regulation, and end-use requirements.

A key development for the bismuth market occurred from late 2024 into early 2025, when China introduced and subsequently tightened export controls on bismuth products, leading to the highest prices in 17 years (Reuters). While these measures did not constitute a full export ban, they increased administrative oversight and reduced flexibility in international supply flows, reinforcing bismuth’s sensitivity to policy decisions.

Because bismuth is produced primarily as a by-product of base-metal refining, and because China dominates both production and downstream processing, regulatory intervention has a disproportionate impact on supply available to international markets.

On the demand side, bismuth benefits from a broad and diversified application base. Its role as a non-toxic substitute for lead underpins long-term consumption across free-machining alloys, electronics, medical products, pigments, and low-melting-point alloys. Regulatory and environmental standards continue to reinforce this substitution trend, particularly in Europe, North America, and parts of Asia.

Taken together, these factors point to a market defined more by structural tightness than by cyclical swings, with pricing increasingly influenced by regulation and supply-chain resilience rather than speculative demand.

What changed in 2025

China tightened export oversight for bismuth products, increasing administrative requirements and reducing flexibility for international buyers sourcing material outside long-established channels.

Industrial users placed greater emphasis on supply reliability, securing material through established, compliant suppliers rather than relying on opportunistic or short-term spot purchases.

- Regulatory pressure to reduce the use of toxic materials, particularly in Europe and North America, has accelerated lead substitution, while the EU’s critical raw materials policy has increased strategic focus on secure bismuth supply.

- Supply diversification progressed slowly, with limited new refining capacity outside China, keeping global availability concentrated and relatively inflexible.

What this means for bismuth

Bismuth is best understood as a structurally constrained market rather than a cyclically responsive one. Because production depends on broader base-metal refining activity, higher prices do not readily translate into higher output. This limits supply-side flexibility and increases the market’s sensitivity to regulatory or logistical disruptions.

At the same time, bismuth demand is largely driven by industrial necessity and regulatory compliance rather than discretionary consumption. This tends to dampen extreme volatility while supporting a stable underlying demand profile.

Price drivers tilting upward

Concentrated production and refining capacity, with China as the dominant supplier.

Continued substitution of lead driven by environmental and safety regulations.

Limited ability to increase supply independently of base-metal production.

Compliance-driven demand from industrial and electronics manufacturers.

Potential headwinds to watch

Fluctuations in base-metal refining volumes that indirectly affect bismuth output.

Technological substitution in specific niche applications over longer time horizons.

Broader industrial slowdowns that may temporarily soften demand.

6–12 month forecast view

Bias: Firm to stable

Rationale:

Export oversight continues to constrain non-Chinese supply.

Industrial demand remains steady and regulation-driven.

Market structure limits sharp short-term price movements.

12–24 month forecast view

Bias: Gradual upward bias

Rationale:

Structural supply constraints remain in place.

Lead substitution trends continue to support incremental demand.

Limited diversification of refining capacity sustains market tightness.

3–5 year forecast view

Bias: Constructive, regulation-supported outlook

Rationale:

By-product production caps long-term expansion potential.

Environmental and safety regulations provide durable demand support.

Long lead times for alternative supply chains reduce downside risk.

Why physical bismuth fits the Strategic Metals Invest framework

Structurally limited supply: production cannot respond quickly to higher demand.

Policy sensitivity: export controls and regulation materially influence availability.

Regulation-driven demand: bismuth benefits from long-term lead substitution trends.

Small-market dynamics: modest shifts in supply conditions can drive meaningful price adjustments.

How to Buy Bismuth

Industrial users of bismuth, including manufacturers in the automotive sector (such as Bosch and ZF Friedrichshafen), electronics (such as Panasonic and Samsung Electronics), medical applications (such as Bayer and Johnson & Johnson), and materials science (such as 3M and Henkel), typically source the metal through established specialty metals dealers.

These intermediaries act as the link between producers and end users, ensuring consistent quality, regulatory compliance, and reliable delivery for industrial-scale applications.

Smaller quantities of bismuth can sometimes be found via online platforms such as Amazon Marketplace, eBay, or Alibaba. However, this route is generally suited to laboratory use or hobbyists rather than to industrial buyers or investors, as material purity, certification, provenance, and resale options are often unclear or inconsistent.

Reputable metals dealers like ourselves provide full chain-of-custody documentation, guaranteeing industrial-grade bismuth purity (min. 99.99%) and traceability. We also arrange professional storage under controlled conditions, allowing investors to hold physical bismuth securely while preserving liquidity and resale potential.

Unlike exchange-traded metals, bismuth is not traded on a liquid futures market. Pricing is determined through direct transactions within the industrial supply chain, making access through established dealers essential for transparency, quality assurance, and dependable market access.

How to Sell Bismuth

For holders of industrial-grade bismuth, the most reliable route to resale is through established specialty metals dealers. Professional buyers require verified chain-of-custody documentation, material certification, and traceability, all of which are typically only available when bismuth has been sourced and stored through recognised market participants.

Bismuth purchased via online marketplaces such as eBay, Alibaba, or Amazon generally offers limited resale options. In these cases, resale is usually restricted to private buyers or small-scale users, and achieving prevailing industrial-market prices is unlikely due to uncertainties about purity, provenance, and suitability for regulated applications.

By contrast, investors who hold bismuth through us benefit from direct access to industrial resale channels. Because the material is fully documented, certified, and professionally stored under controlled conditions, liquidation can typically be arranged efficiently and at prices aligned with current market conditions.

All prices on this page last updated Feb 23 2026.