Weekly News Review September 9 – September 15 2024

September 15, 2024

Weekly News Review September 16 – September 22 2024

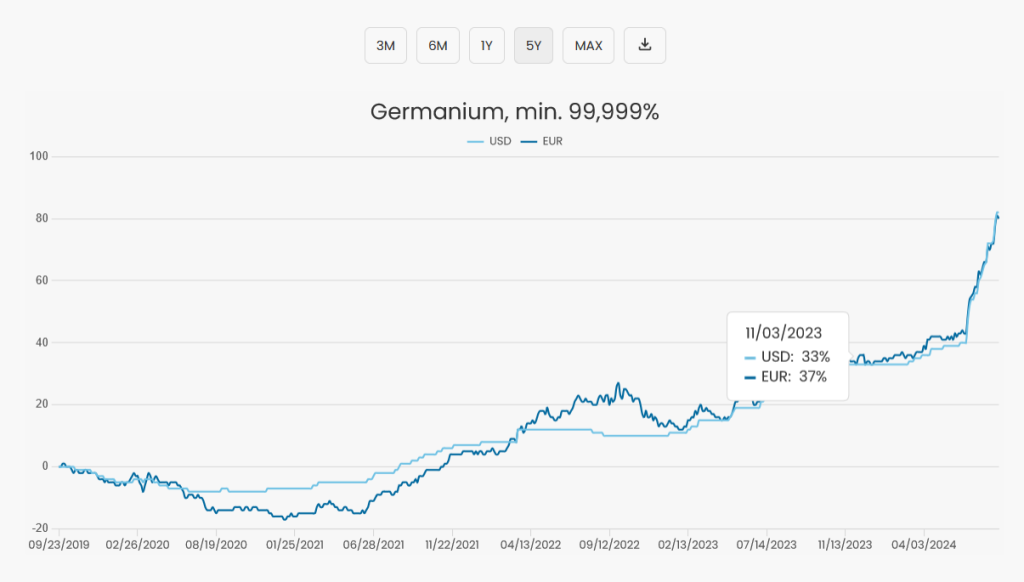

September 22, 2024Germanium’s significance as a critical metal is growing exponentially, with analysts predicting that demand will outstrip supply by six to nine times by 2030. This surge is driven by a combination of technological advancements and an increasingly complex geopolitical landscape. In fact, germanium prices have already risen by over 30% this year and 65% since the start of 2023, making it one of the most talked-about metals for strategic investors (click here to view Germanium’s price and 10-year historical price charts).

Key Drivers of Germanium Demand

One of the primary forces behind germanium’s skyrocketing demand is its indispensable role in infrared optics. As autonomous vehicles and advanced driver-assistance systems (ADAS) become more mainstream, germanium is crucial for producing night vision devices and thermal imaging cameras. What was once a luxury feature in high-end vehicles is now becoming standard, with mid-range cars projected to adopt this technology in the coming years. The expansion of germanium’s use in blind-spot detection, autonomous driving, and security automation is expected to create an unprecedented surge in demand.

Fiber Optics: The Backbone of Global Connectivity

Beyond automotive applications, germanium plays a critical role in fiber optics, which form the backbone of global high-speed internet infrastructures. Governments worldwide are pushing for the expansion of nationwide high-speed internet, and fiber optic networks are at the heart of this initiative. Germanium’s unique properties make it essential for these systems, with demand expected to increase eightfold in this sector alone. As supply constraints become more apparent, prices will likely continue their upward trajectory.

Semiconductors and Geopolitical Tensions

The global semiconductor race is another key area where germanium’s strategic importance shines. The competition between the US and China for dominance in semiconductor technology has brought germanium into the spotlight, especially given its critical role in high-performance processors. Taiwan, which produces 92% of the world’s most advanced semiconductors, is a focal point of these tensions, with both global powers vying for control. As the Cold War 2.0 unfolds on this new technological battleground, germanium’s value continues to climb.

In addition to semiconductors, germanium is a critical component in photovoltaics and recyclable PET bottles, further driving its demand across multiple industries.

The Impact of Chinese Export Restrictions

Despite its widespread use, China dominates 80% of the global germanium production market. In July 2023, China introduced export restrictions on germanium, which came into effect on August 1st, 2023. This move is widely seen as a response to US efforts to curb China’s access to cutting-edge semiconductor technology. The result? Concerns about supply shortages in Western markets, with European and North American countries scrambling to find alternative sources. While recycling efforts are underway, they are far from sufficient to bridge the gap in supply.

Market Outlook: Soaring Demand and Shrinking Supply

The combination of soaring demand and shrinking supply has created a perfect storm for price hikes. Industry insiders are optimistic, with the Fraunhofer Institute projecting a significant increase in demand across high-tech sectors through 2035. Beyond 2030, the situation may worsen as delays in developing non-Chinese supply chains could exacerbate shortages.

All signs point to germanium being a profitable medium to long-term investment. As the tightrope between constrained supply and growing demand becomes ever more delicate, germanium represents one of the most attractive opportunities for investors looking to benefit from the technological revolution of the 21st century.