Neodymium Prices

The current price of Neodymium is $204.90 per kg.

Please note that this price is the retail price for private investors and is aligned with industry retail pricing. For bulk neodymium purchases, whether investment or industry, please contact us directly for a quotation.

Table: Neodymium Historical Prices and Price Changes

| Date | Neodymium Price | Change % to Today | Annual Change % |

|---|---|---|---|

| Feb 24 2026 | $204.90 / kg | ||

| Jan 1 2026 | $149.30 / kg | +37.24% | |

| Jan 1 2025 | $96.10 / kg | +113.22% | +55.36% |

| Jan 1 2024 | $113.20 / kg | +81.01% | -15.95% |

| Jan 1 2023 | $209.30 / kg | –2.10% | -45.91% |

| Jan 1 2022 | $222.80 / kg | –8.03% | -6.06% |

| Jan 1 2021 | $109.70 / kg | +86.78% | +103.10% |

| Jan 1 2020 | $65.00 / kg | +215.23% | +68.77% |

| Jan 1 2019 | $66.05 / kg | -1.59% | -1.59% |

| Jan 1 2018 | $70.04 / kg | +192.55% | -5.70% |

Neodymium Historical Price Movement

At today’s price of $204.90 per kg, neodymium changed +37.24% since the start of 2026 and has risen +113.22% since the start of last year. It’s up +81.01% since January 2024, but lost –2.10% since January 2023.

Compared to its price of $109.70 per kg on Jan 1st 2021, it has gained +86.78%. If we go back further to Jan 1st 2018, when the cost of neodymium was $70.04 per kg, then this rare earth metal has advanced +192.55%.

Neodymium is a rare earth element that is found in the earth’s crust. Its metallic element number is 60 and its chemical symbol is Nd. It is categorized as a lanthanide.

To make a qualified prediction of neodymium’s future pricing trends, let’s first examine its current applications and consider the key countries manufacturing this rare earth element (jump to our forecast here).

Neodymium Uses

Neodymium

Neodymium has been used since the early 1950s to create magnets with higher magnetic properties than those made with iron or other metals. Neodymium magnets, composed of neodymium, iron, and boron (NdFeB), can permanently carry up to 1,300 times their own weight, and are used in a wide range of products, ranging from fridge magnets to aircraft engines.

In electronics, neodymium magnets enable data storage in computer hard drives and deliver clear sound in mobile phone speakers and microphones; key innovations that made today’s lightweight devices possible.

Demand from renewable energy and electric mobility continues to rise: neodymium-iron-boron magnets power wind turbines, hybrid vehicles, and electric cars, making them the largest users of high-performance neodymium magnets worldwide. The element is also gaining traction in next-generation medical devices, such as wearable sensors and magnetically guided therapies, alongside its established uses in MRI machines, surgical lasers, and pacemakers.

Neodymium also has decorative applications, being one of the components used to make beautiful glass with hues ranging from yellow-green to deep violet. It can also be combined with other elements to create items, such as glasses that block infrared radiation, creating goggles for welding and cutting operations.

Its applications and versatility make neodymium one of the most effective rare earth elements available commercially today.

Where is Neodymium Produced?

Neodymium is rarely found in nature as a free element. It occurs in mineral ores such as bastnäsite and monazite, which contain a mix of rare earth elements in varying concentrations. While global reserves are estimated at around eight million tonnes, extraction and separation are technically complex and often environmentally challenging, factors that make neodymium both valuable and strategically sensitive.

The main mining regions include China, the United States, Brazil, Russia, Sri Lanka, India, and Australia. However, China dominates production, accounting for roughly 85% of global output, largely due to its advanced refining and separation capacity, rather than mining volume alone.

What Factors Determine the Price of Neodymium?

Like all commodities, the price of neodymium is ultimately driven by supply and demand. Its unique magnetic strength and importance for clean-energy technologies make it one of the most valuable materials in modern industry. As demand for electric vehicles, wind power, and high-efficiency electronics continues to grow, so does demand for neodymium.

The bulk of the global supply still comes from China, which controls roughly 85% of the refining capacity. Beijing’s strategic management of its rare-earth industry, including export quotas and environmental regulations, has historically led to sharp price fluctuations. In 2010, for instance, China restricted rare-earth exports and temporarily halted shipments to Japan following a diplomatic dispute, sending prices soaring.

Today, China’s export policy remains the single biggest influence on neodymium pricing worldwide, making it not just an industrial metal but also a strategic barometer of geopolitical tension.

Neodymium Price Forecast

At a glance

- The neodymium price rose sharply in 2025, up 55%.

- Macro driver: magnets for EVs and wind turbines remain the backbone of demand for neodymium; both markets logged strong momentum in 2024–2025.

- New twist: Beijing has suspended its new rare-earth export controls for one year as part of a US-China détente, removing a near-term supply shock but not the long-term concentration risk (only recent export controls that were not yet in place were suspended; several longer-term ones remain in place).

What changed in 2025

- The price trend flipped convincingly positive, with neodymium up 55% on our USD retail benchmark. That puts it above 2021 levels but still off the 2022/2023 highs.

- Policy risk eased temporarily. China has paused the controls on rare earth and related materials it rolled out in October, in tandem with a broader one-year truce on several US-China trade frictions.

- Real-economy demand remained constructive: EV sales continued to climb in 2025, and global wind set another record year for new installations, both of which were supportive of NdFeB magnet demand.

What this means for Neodymium

The one-year policy pause reduces tail-risk spikes, but it doesn’t fix structural issues, such as heavy supply concentration in China, constrained new supply growth, and rising magnet demand (including from new medical-tech applications). In other words, volatility may cool in the very short term while medium-term fundamentals remain tight (especially if magnet capacity growth outpaces oxide separation growth).

Price drivers tilting upward

- EVs: The IEA’s 2025 outlook shows continued growth in EV sales, with each car serving as a small magnet factory on wheels.

- Wind: GWEC reports another record year of installations, supporting large direct-drive turbines that favor neodymium-rich magnets.

- Medical-tech frontier: Next-generation wearables and magnetically guided cancer treatment systems are emerging as incremental new demand sources for neodymium.

- Inventory rebuilding: Following two choppy years, OEMs and magnet manufacturers tend to rebuild their inventories, adding incremental demand in the short to medium term.

- Policy risk premium: China’s one-year suspension of export controls offers temporary relief but keeps the long-term risk alive. Markets tend to price that uncertainty in advance, often leading to precautionary buying and higher baseline prices for neodymium.

Potential headwinds to watch

- Substitution/efficiency: Incremental gains in magnet thrift (neodymium/praseodymium ratios, heavy rare earths reduction) could cap upside in extreme rallies. (IEA’s critical minerals work highlights tech-driven intensity changes.)

- Supply-side bottlenecks: While concentration risk is a tailwind for prices, it also means that any large new supply injection could quickly transform the dynamic. However, Western projects will take years to reach meaningful scale. Mining rare-earth ores is the easy part, but the real challenge is processing. Neodymium doesn’t occur naturally; it must be separated from a complex mix of elements through advanced chemical refining. China has spent over 30 years mastering that process and still controls roughly 85 % of global refining capacity. Even though the U.S., Australia, and the EU are securing new deposits and launching projects, building full separation and magnet-production chains is a generational effort. It’s not just about equipment; it’s about expertise. China graduates thousands of rare-earth chemists and metallurgists each year, while the U.S. and Europe are only now rebuilding that talent pipeline. Under a new Trump administration, policy support may accelerate the issuance of mining permits and funding; however, the human and technical capacity gap is likely to persist well into the mid-2030s.

6–12 month forecast view

Bias: Slightly bullish

Rationale: Demand from EVs and wind remains resilient; the one-year policy truce removes a near-term brake on flows, encouraging restocking into a rising market trend. With neodymium already up ~56% YTD, we expect higher-lows behavior with episodic pullbacks rather than a straight line.

12–24 month forecast view

Bias: Moderately bullish (upward drift with occasional volatility)

Rationale: As the China export-control pause nears expiry, precautionary buying could drive incremental upside. Meanwhile, the IEA expects magnet demand to continue climbing, while new non-China supply is slow to come online, supporting the upside potential. Expect volatility around policy headlines and procurement cycles.

3–5 year forecast view

Bias: Constructively bullish

Rationale: Geographical concentration of refining capacity and environmental constraints on project expansion outside China mean supply growth is likely to remain challenged. Coupled with expanding applications (mobility, grid, medical-tech), the medium-term outlook supports higher average prices versus the 2023-24 baseline.

Why physical Neodymium fits the Strategic Metals Invest playbook

- Direct exposure to electrification and next-gen tech: Physical neodymium provides hands-on leverage to electric-motor and high-efficiency generator trends, as well as emerging medical device applications.

- Policy upside built-in: With China’s dominance in refining and export policy, physical holdings benefit if controls return, or even if tighter regulations simply raise the perceived risk premium.

- Continuation of thematic narrative: The US-China dynamic (including the Trump–Xi thaw) keeps rare earths in the strategic spotlight. Owning physical neodymium means staying ahead of the narrative, not just riding it.

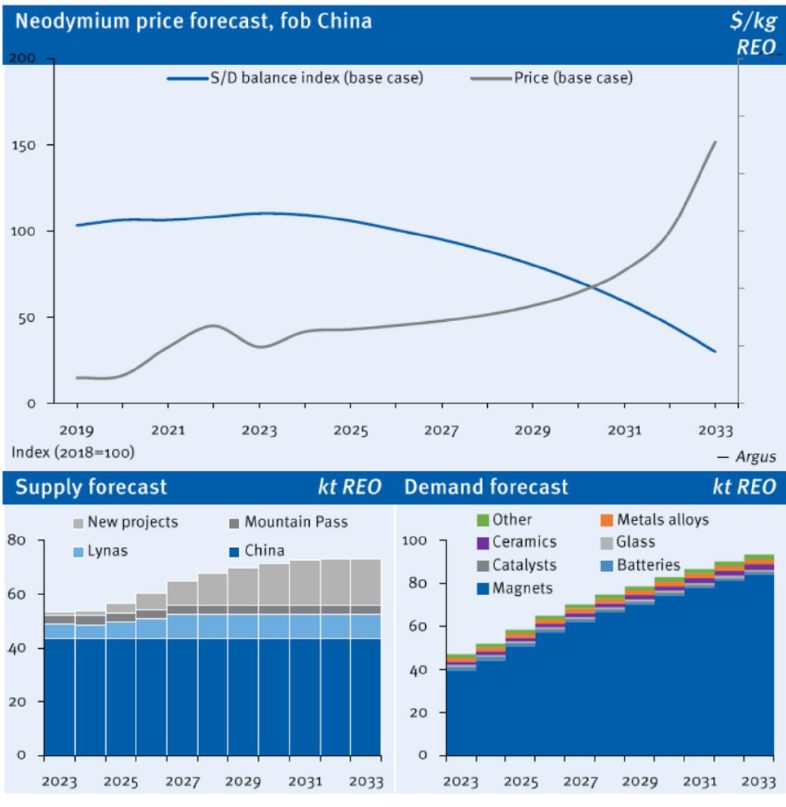

The graphs below show Argus Media’s forecasts for Neodymium’s future price (fob China), demand, and supply.

How to Buy Neodymium

If you Google search “buy neodymium” the first results all sell neodymium magnets. As an investor, you’d have to look for “neodymium oxide”, the powder form, which you’ll find at several online suppliers and marketplaces like Amazon, Alibaba, Etsy, and eBay.

You must realize though that you must purchase from a reputable dealer to ensure the purity. Otherwise, there’s only the possibility of selling again to other hobbyists, meaning you may not profit from any price gains.

Corporate buyers like Tesla, Honda, Ford, Rolls-Royce, and BMW only use licensed metal dealers, like ourselves, to purchase the industry-grade neodymium they need in their production process. We act as a key intermediary between the producers of strategic raw materials and the industry users.

Any serious investor who wants to benefit from future neodymium price increases by buying and physically owning this metal can do this safely through us. We’re the only globally licensed industry supplier offering this to private investors. We sell industry-grade neodymium oxide powder (Nd2O3/TREO) at a minimum of 99.0% purity, the minimum purity form preferred by the aviation, car manufacturing, and wind turbine industries. We also offer safe storage, a requirement if you want to sell again to the market in the future.

Neodymium futures contracts are also traded in the Shanghai Metal Market (SMM).

How to Sell Neodymium

If you own some neodymium oxide powder, you can easily sell it online to other hobbyists at sites like eBay, Amazon marketplace, or Esty. However, you won’t get market rates because industry buyers like Mercedes, GE Aviation, and Chevrolet only buy their industrial-grade neodymium oxide from trusted licensed industry suppliers.

These companies will only transact with a seller that provides documentary evidence of the entire chain of custody, purity reports, and proof of proper storage. Because we’re such an industry metals supplier, we guarantee the fast and safe liquidation of our investors’ neodymium at market rates to the industries using it.

All prices on this page last updated Feb 24 2026.