Weekly News Review June 16 – June 22 2025

June 22, 2025

Weekly News Review June 23 – June 29 2025

June 29, 2025Today, we will take a deep dive behind the scenes and inform you of what’s happening on the industry side of the supply chain. Rare Earths have been making global headlines almost daily this year. It used to be that every six months or so, they would make the news. However, as the world pivots from oil to metals, rare earths have become the new frontline in geopolitical decisions.

Of genuine interest and substance so far in 2025 is not just the fact that demand is rising but also that demand is being institutionalized by national interest and strategic stockpiling.

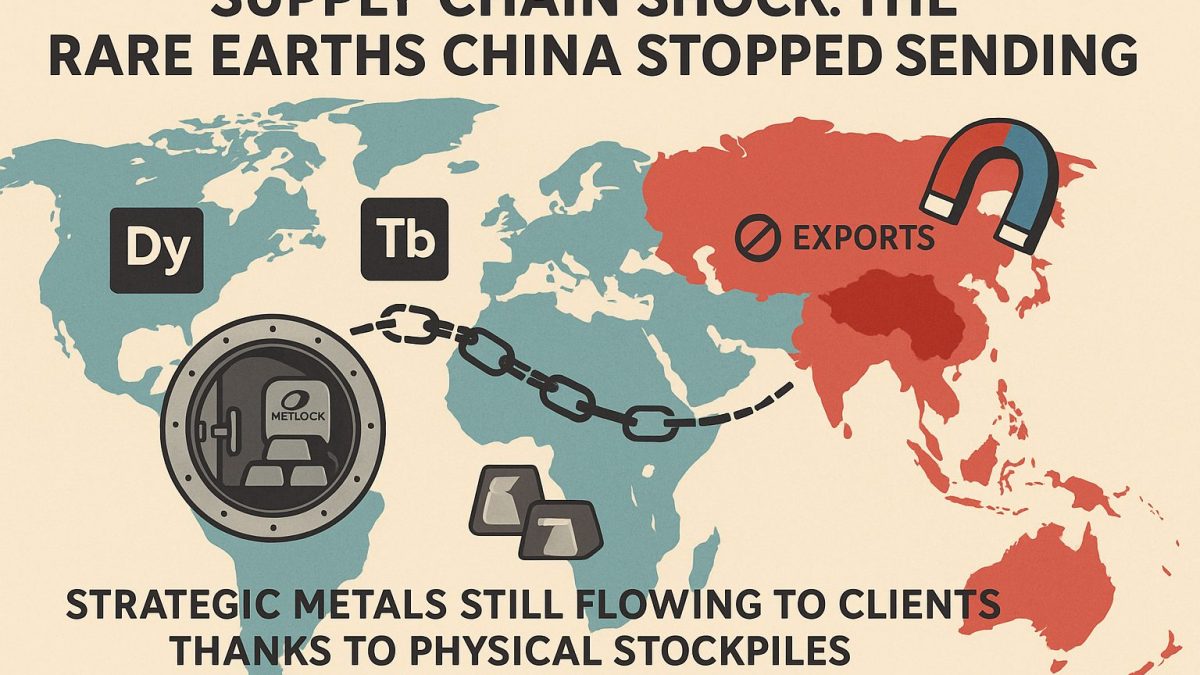

Since April 4th, China introduced further export restrictions on seven rare earths, and none of these rare earths have left China since that day.

Let’s examine how this is now impacting the supply chain.

China’s export restrictions for certain rare earths are having an impact, threatening shortages in Europe. Suzuki halted production of the Swift car due to a shortage of rare earths. The CEO of Ford Motor Company announced that they had three to four months of inventory, after which there would be production shutdowns.

The good news is that on the industry side, we are still trading due to our distinctive business model.

Despite the lack of exports of heavy rare earths dysprosium and Terbium from China in May, we were able to continue supplying our industrial customers reliably. This is made possible by a business model based on physical possession and professional storage, which is unique in this form in Europe.

CHINESE EXPORTS OF DYSPROSIUM AND TERBIUM FELL TO ZERO IN MAY:

In April, China introduced export restrictions for several rare earths. The latest data from the Chinese customs authorities now show the full impact of these measures, as exports of dysprosium and terbium came to a standstill in May. A decline in exports was already evident in April.

In the summer of 2023, China introduced similar controls for gallium and germanium, resulting in a temporary ban on exports. The processing time for licenses was approximately 45 working days, which may indicate the duration of the current measures for rare earths.

Dysprosium and terbium are key raw materials for high-tech industries, particularly in neodymium-iron-boron magnets (NdFeB), which are utilized in electric cars, wind turbines, and the defense sector. The elements belong to the so-called heavy rare earths, which are almost exclusively produced in China and Myanmar. Western industry is, therefore, highly dependent on them. The Chinese trade measures have been dominating the news in the commodity markets for weeks.

MAGNET EXPORTS ALSO AFFECTED:

Exports of rare earth magnets from China have also fallen sharply recently. These often contain dysprosium or terbium. Although Chinese customs authorities do not currently differentiate between magnets with and without these critical elements, analysts assume that the standardized classification will result in increased inspections—and thus further delay exports.

ON THE INDUSTRY SIDE, WE WERE ABLE TO SUPPLY – EVEN IN A CRISIS:

While many retailers and processing companies are experiencing a scarcity of rare earths, the strength of a forward-looking business model is demonstrated by the fact that we have been able to continue supplying our customers with dysprosium and terbium in recent weeks. Thanks to physically available stocks, which are stored under secure conditions at the Frankfurt site.

“We are currently experiencing how important it is not only to trade raw materials but to keep them physically available. Our customers benefit from having access to strategically relevant metals through us, regardless of whether supply chains are functioning or not,” says Jan Giese, our Senior Manager of Minor Metals and Rare Earths at TRADIUM.

Private individuals can order strategic metals, such as dysprosium and terbium, from TRADIUM, thereby acquiring tangible assets and becoming an essential link in international supply chains. Subsequent sales are made directly to processing companies via the company’s established industrial contacts. A model that sensibly combines the acquisition of material assets and security of supply.

MAJOR WAKE-UP CALL FOR INDUSTRY AND GEO POLITICS:

Current developments demonstrate the uncertainty surrounding the supply of critical raw materials. For many branches of industry, this could be the reason to rethink their stockpiling strategy.

On the industry side, we focus on long-term availability, enabling businesses to establish physical warehousing as part of their risk management strategy.

Running parallel to this, we invite private investors to participate and profit from supply chain shortages. This has been recently demonstrated by our offers to repurchase Dysprosium and Terbium from private clients at a 20% premium over market prices in their favor.

Contact us if you want to learn more about how you can add these restricted raw materials to your portfolio