Inflation Reduction Act (IRA) – How investors can PROFIT

November 8, 2023

End Of Year Summary 2023

December 20, 2023Many people purchase strategic metals as alternative physical assets. However, raw material prices can fluctuate, just like stocks or funds.

In this piece, I use my knowledge and experience as a strategic metals commodities expert to explain what moves the prices of these metals.

Volatility is the range of fluctuation in prices or rates. Are they rising? Are they going down? And by how much do the highs and lows vary?

Some of you have probably heard the term “volatility” referencing the stock exchange. If a stock rises or falls conspicuously, it’s called volatile. The term also applies to raw materials such as strategic metals, whose prices are often in motion.

If there’s a shift in the supply or demand for raw materials, their prices will change. An oversupply of a physically available material usually causes prices to fall. However, if metals are in short supply and there are bottlenecks, this is called an undersupply. Rising prices typically accompany this situation.

As a rule, volatility skyrockets when fundamental changes occur. The Covid-19 years are an excellent example of this. The global supply chains for strategic metals like gallium, germanium, and rare earths kept breaking down, and supplies collapsed. This caused prices of these increasingly scarce raw materials to rise sharply.

Russia’s attack on Ukraine in February 2022 was a milestone in the price development of the platinum group metal palladium. Russia is one of the most critical palladium-producing countries.

After sanctions were imposed on the country, there were shortages and price spikes for the metal, mainly used in catalytic converters.

In summary, wars and pandemics are causes of price volatility; however, there are other less extreme causes. As an example, let’s continue with palladium.

In South Africa, one of the world’s leading suppliers, there are persistent problems with the domestic power supply. Electricity often has to be cut off for hours at a time. It’s easy to imagine the impact this has on the energy-intensive mining and processing of these metals.

Less platinum and palladium are coming to market, considerably less than expected; thus, the supply is becoming tighter.

Often, there are also political decisions behind this. At the beginning of 2023, the EU Parliament sealed the deal on the phasing out of combustion engines after 2035.

Metals such as palladium, which are used in catalytic converters, are, therefore, in danger of losing their importance in the long term.

In the short term, the EU decision won’t impact purchasing volumes, as cars with combustion engines will continue to be built. Nevertheless, prices have moved downward.

But it also works the other way around: the German federal government has spoken out in favour of transitioning from fossil fuels to renewable energy sources. This suggests that demand for rare earths will likely increase long-term.

These metals are used in large quantities in permanent magnets, without which many wind turbines wouldn’t run. The mining and processing of rare earths is heavily concentrated in China, and Europe’s dependence on raw material imports is correspondingly high. This limitation could have an impact on prices.

Not all strategic metals are volatile; some are considered stable, and their price development is more like a sideways movement – that is, they remain stable.

For example, the long-term market view of the technology metals Rhenium is very balanced. The supply and demand relationship shifts slightly, and the price fluctuates less erratically.

Here is our suggestion on what to look for regarding price volatility, as private investors can take advantage of price volatility.

Volatility offers opportunities for gains but also the risk of losses. From a risk management perspective, private buyers should carefully select and broadly diversify their strategic metals to avoid the impact of excessive volatility on a portfolio.

In addition to metals with high volatility, some fluctuate little in price, and whose value remains relatively stable. This can make sense to dampen the fluctuations, which are usually offset in the long term. A holding period of several years is, therefore, sensible.

Look at the “path of progress” – what is the future like? What transitions are coming?

For example, the demand for energy transition metals (Gallium, Dysprosium, Neodymium, Praseodymium, and Terbium) will far exceed supply from 2025 until 2030. The likelihood of price increases is manifest and a great opportunity.

If you would like to learn more, please contact us.

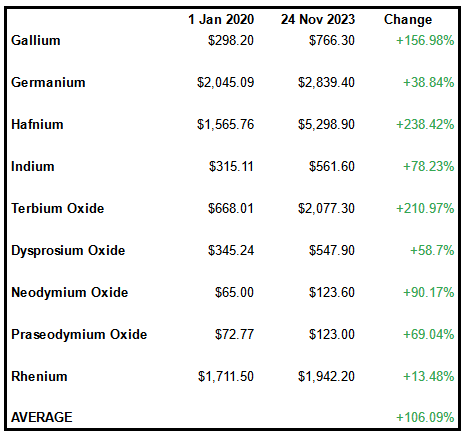

Strategic Metals Performance Since Jan 1st, 2020: