Buy Gold or Buy Strategic Metals in 2022?

May 31, 2022

An Introduction to Germany’s Ft. Knox

July 26, 2022Strategic Metals: The Future of Hedging Against Inflation

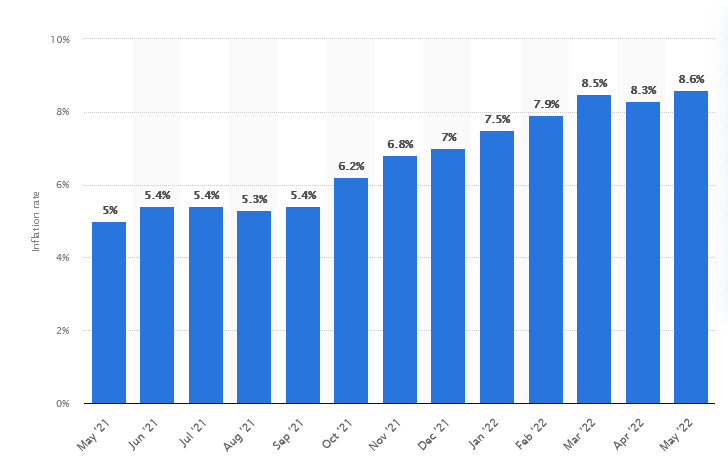

Buying groceries and petrol has become more expensive over the past year as inflation rates in the US and Europe hit their highest levels in 40 years. Investors are looking to hedge their portfolios against inflation. Considering that it is now possible to safely buy and store rare earths and strategic metals in the same way as purchasing precious metals, could strategic metals be considered an inflation hedge as well?

Historically, many investors turn to gold when they are concerned about inflation. Gold is often seen as a hedge against inflation because it retains its value even when prices for other goods and services rise. This is because gold is a scarce commodity not subject to the whims of central bankers or other policymakers. I.e., central governments cannot simply print more gold like they can with currencies, and as a result, its value is preserved.

Gold is therefore often seen as a good way to preserve wealth during periods of inflation. However, gold does have some drawbacks as an investment. For example, it does not generate income as stocks and bonds do, and its price can be volatile. Nonetheless, gold remains a popular inflation hedge for many investors.

Historically, this theory has been supported by the data, with gold prices typically rising during periods of high inflation. However, this relationship seems to have broken down over the past year. US inflation levels have tripled from March 2021 (2.6%) to April 2022 (8.3%).

Yet gold prices only increased by 15% from March 2021 to March 2022, and they’ve lost 10% of this peak value in recent months.

Despite inflation levels not seen since the early 1980s, gold prices have only increased by a small amount (arguably less than the level of inflation).

So why isn’t gold reacting to inflation the way it has in the past? There are a few possible explanations. First, investors may be anticipating higher interest rates in the future, which would cause gold prices to drop. Alternatively, some experts believe that gold was already trading at very high levels due to the COVID-19 situation. No matter the reason, it’s clear that gold is no longer the infallible inflation hedge it once was.

On the other hand, the price of strategic metals is driven more by their supply and demand dynamics than by inflationary pressures. This is because strategic metals are rarer than other commodities, so their prices are more sensitive to changes in supply and demand. However, this also means that strategic metals can be a contributing factor to inflationary pressures. Rising prices for rare earth metals and other strategic metals make producing goods that use these materials more expensive, leading to higher prices for consumers.

We have seen significant price increases in our strategic metals over the past year, with several of our rare earths doubling in value. One reason for this is inflation. As the US dollar loses purchasing power, the price of goods denominated in dollars must increase to maintain their real value. This is especially true for commodities priced in dollars on international markets. Thus, we can expect continued price increases in strategic metals as long as inflation remains a problem.

Another factor contributing to the price hikes is the growing demand for these metals (and their limited supply). Rare earth metals are used in various high-tech applications, ranging from cell phones to electric vehicles. The demand for these metals will only increase as the world becomes increasingly digitized and greener. Similarly, strategic metals are used in various critical industries, such as aerospace and defense. These industries are only expected to grow in a time of global uncertainty, creating further demand for strategic metals. As a result of these trends, we can expect prices for strategic metals to continue to rise.

So while gold has been revered as a store of value and a hedge against inflation for centuries, this relationship has not held true in recent years. Despite high inflation levels, gold prices have not risen over the past year. While there are several possible explanations for this, it is clear that gold is no longer the reliable hedge against inflation it once was.

So as investors are now turning to other assets, there is a solid argument for buying and storing rare earths and strategic metals as an inflation hedge. Not only do their prices go up during inflationary periods, but their demand also continues to grow. Strategic metals remain an essential part of our economy and will continue to play a crucial role in our future.

Please don’t hesitate to contact us if you would like more information about how you can safely purchase and store these Strategic Metals and inflation proof your investment portfolio.