Cold War 2.0 Will Be a Race for Semiconductors, Not Arms

June 28, 2023

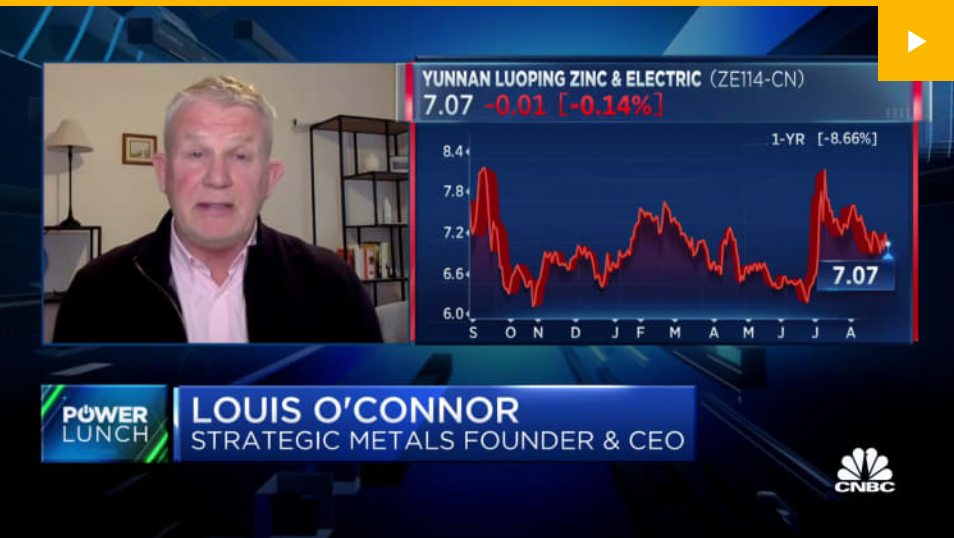

Our CEO Louis Breaks down China-U.S. Rare Metal Wars on CNBC

August 30, 2023We have had a lot of news from the industry in the past 2 weeks, particularly China’s announcement to ban the export of Gallium and Germanium beginning August 1st.

Is the price slide over?

The several months of falling prices for rare earths appear to be coming to an end. With an increasing demand for energy transition technologies, such as wind turbines and electric cars, current signals indicate that the market is stabilizing and a price recovery is imminent.

As we know, the raw materials known as rare earths play a critical role in the world’s energy transition away from fossil fuels. Among other things, these strategic metals are used in the permanent magnets installed in wind turbines and electric cars, which are experiencing steadily increasing demand.

In this context, it initially appears surprising that prices of rare earths have fallen noticeably in recent months. For example, neodymium, a magnetic material of central importance to the energy and transport revolution, was 11% cheaper in May than in April. This is the finding of the monthly price monitor published by the German Commodity Agency. Other representatives of this element group, such as dysprosium, also dropped in price.

Since the beginning of June, there have been increasing signs that the decline, which began in January 2023 (as reported), has ended, and prices are stabilizing. The market seems to have explored its pain threshold and is in the process of forming a bottom.

What is behind the surprising price drop?

The historic fall in the price of rare earths since the beginning of 2023 came as a surprise, even to many market observers. Typically, it would be expected that high demand would keep prices up. This would also be supported by the fact that China had reduced its exports in recent months, thus tightening the overall supply. However, other factors besides industrial demand and export quotas play a role in price-setting.

Some of these are to be found in China itself: the first quarter, for example, is traditionally relatively weak, as this is the Chinese New Year when mines and processing plants and other parts of industry shut down for a holiday. This naturally reduces domestic demand for raw materials such as rare earths.

Unique factors – such as the many months of a consistent zero-Covid strategy and strict lockdowns of megacities – have also left their mark on the domestic economy and are weighing on the industry. This also applies to Chinese consumption of products such as E.V.s, one of the drivers of demand for rare earths along with wind turbines.

Outside China – in Germany, for example – there has been a reduction in e-car registrations since the beginning of the year. Consumers are holding back on purchases due to unclear electricity price developments, expiring government subsidies in many countries, and the sluggish expansion of charging infrastructure.

Nevertheless, China remains the world’s largest e-mobility sales market, and its fleet’s share of electric cars is growing faster than in Europe or the U.S.

Unsurprisingly, the People’s Republic is therefore expected to increase its domestic demand for these raw materials in the medium term, which also explains the recent increase in the state mining quota for rare earths.

Consolidation in the market looms.

It is undisputed that China, with its quasi-monopoly on rare earths, can significantly influence global pricing. However, as new players enter the commodities market, the rules of the game could change. Countries like the U.S. and Australia, rich in mineral resources, want to expand resource extraction. In Vietnam, too, there are strong efforts to promote domestic mining and processing of rare earths.

Recent years’ very high raw material prices have also made investment in (national) recycling processes attractive. In addition, the cost increases may have had another effect. Given the price spikes for neodymium and other rare earth elements in recent months, some purchasing departments would have exercised restraint if their stockpiling allowed it. Experience has shown that buyers usually replenish their stocks quickly when raw material prices fall. This, in turn, corrects prices upward.

In addition, the initial drop in prices and rising energy prices made it almost impossible for many mining companies outside China to extract the raw materials at a cost-recovery level. The further processing of rare earths by downstream refiners, which is also energy-intensive, is likely to have been unprofitable in recent months.

It can be assumed that, except for cash flow, raw material sales have been cut back to a minimum, i.e., the material has been sold at a loss to cover operating costs. This could have provided an impetus for an upward price correction.

Therefore, the conditions are suitable for the market and price formation to receive impetus from many players in the medium term.

The other big news, of course, was China’s announcement on July 4 that there would be stricter controls on the export of Gallium and Germanium, which begs the question.

Will China ban the export of all Rare Earth Elements?

As was widely reported last week, these initial restrictions are a warning, a shot across the bow.

Industry observers note this intent is planned, manifest and present. Here is what has occurred so far.

Permission from the Chinese Ministry of Commerce will be required to export the technology metals gallium and germanium.

Starting August 1 this year, China will impose stricter controls on the export of gallium and germanium.

This was stated in a press release from the Chinese Ministry of Commerce on July 4th, 2023. Both technology metals are essential starting materials to produce semiconductors, solar cells, LEDs, and lasers.

According to the U.S. Geological Survey, the People’s Republic has the most significant global gallium and germanium production share.

The announcement also generated much media attention against the political tensions between the U.S. and China.

Nevertheless, it remains unclear how the measures justified with reference to national security will play out in practice. Specifically, they require Chinese exporting companies to apply for a license to send gallium- and germanium-related products in the future. What is needed for the approval or what can lead to a prohibition is not clear from the announcement by the Ministry of Commerce.

However, exporters must provide detailed information about the consignee of the product. Certain compounds of the two metals qualify as dual-use goods for civilian and military use. China may therefore be primarily concerned with controlling the countries to which these raw materials are supplied.

Matthias Rüth, Managing Director of raw materials supplier TRADIUM GmbH, says:

“The News on export restrictions for gallium and germanium has led to nervousness in the market. Many companies are wondering whether their supply chains for raw materials will remain resilient when Chinese exporters must go through licensing from August this year. It would not be the first-time raw materials giant China has played poker with industrial metals and tested its power. Beijing already regulated the export of metals such as rare earths in 2010. At the time, this led to severe price turbulence. Whether it will happen again this time remains to be seen.”

However, industry observers also see the new regulation as a reaction to the U.S.’ efforts to cut China off from the supply of modern semiconductor chips. The Middle Kingdom occupies an almost dominant position in the raw materials sector. Nevertheless, it has not yet been able to catch up technically with the chip industry of South Korea or Taiwan.

According to the wishes of the U.S. and several allies, this status quo should not change. Just one day after China’s announcement on gallium and germanium, plans leaked out from the U.S. government to prohibit Chinese companies from accessing cloud computing services, for example, from Amazon and Microsoft.

All eyes are now on U.S. Treasury Secretary Janet Yellen, who is expected to hold talks in Beijing second week of July (2023). The meeting aims to engage in various discussions, including shaping bilateral relations between the two countries and jointly addressing global challenges.

In conclusion, purchasing rare earth metals is always a wise investment if you plan to hold for a minimum of 3 to 5 years.

However, right now, because of the recent price slide, if you have plans to increase your portfolio, we highly recommend purchasing at least Gallium and Germanium before the restrictions come into effect on August 1.

On a side note, Tradium GmbH, our industry partner and supplier, has been purchasing as much inventory for the industry side as they can in the past few months because of the low prices.

Please contact us for more info.

All the best for now,