Unveiling Paris’ Green Transformation Towards a Cooler Future

August 12, 2024

Weekly News Review August 12 – August 18 2024

August 18, 2024Dysprosium, a linchpin in modern technology, is more than just a rare earth element—it’s a cornerstone for the future, particularly in the rapidly expanding green economy. Essential for everything from nuclear reactors to the high-strength magnets in electric vehicles, wind turbines, and solar panels, dysprosium’s role is set to grow exponentially as the world pivots towards sustainable energy.

The Green Revolution: A Relentless Surge Forward

The green revolution isn’t just a passing trend; it’s a transformative wave reshaping the global economy. The automotive industry, in particular, is steering billions into electric vehicle (EV) production at an unprecedented rate. As of 2023, global automakers and battery manufacturers are planning to invest a staggering $860 billion by 2030 to electrify their fleets and build out essential infrastructure. This includes nearly $210 billion earmarked for investments in the United States alone, making it the largest market for EV investments globally.

In just the past year, several major automakers have announced significant commitments. For example, Ford alone is investing over $50 billion by 2026 to expand its EV lineup and scale production. General Motors is not far behind, with plans to invest $35 billion in EVs and autonomous vehicles by 2025. These enormous sums underscore the critical demand for raw materials that power this shift—chief among them, dysprosium (source: The White House).

The U.S. Department of Energy’s 2011 Prediction: A Crystal Ball for Today

The U.S. Department of Energy was ahead of the curve when it identified dysprosium as the single most critical element for emerging clean energy technologies back in 2011. With no viable substitutes on the horizon and demand set to outstrip supply, it’s no wonder that not just companies but entire nations are stockpiling this strategic metal.

China’s Iron Grip on Supply: A Geopolitical Chess Piece

China controls the lion’s share of dysprosium production, leveraging its dominance not only to supply its own industries but also as a powerful bargaining chip in global trade negotiations. Export quotas and geopolitical tensions only heighten the potential for supply constraints, further driving up prices.

Price Dynamics: A Volatile Yet Lucrative Market

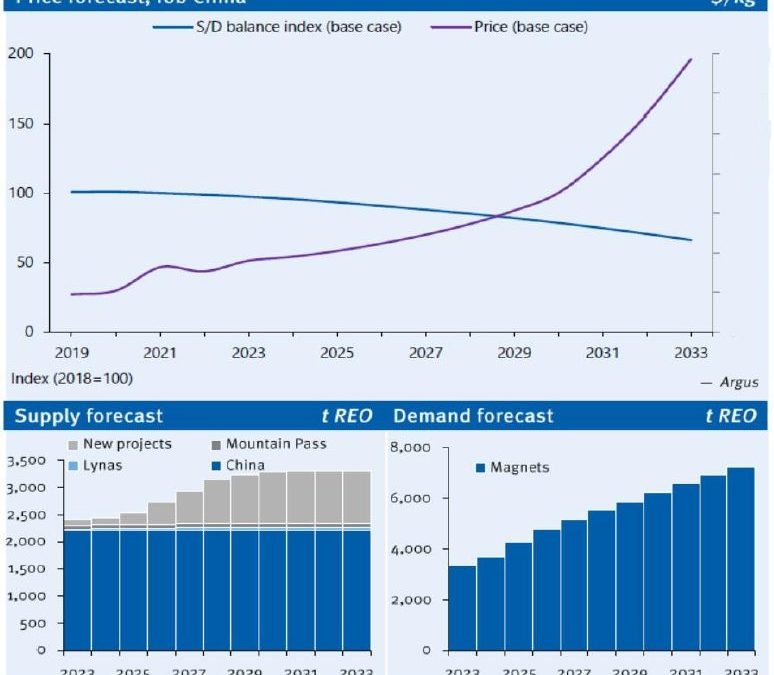

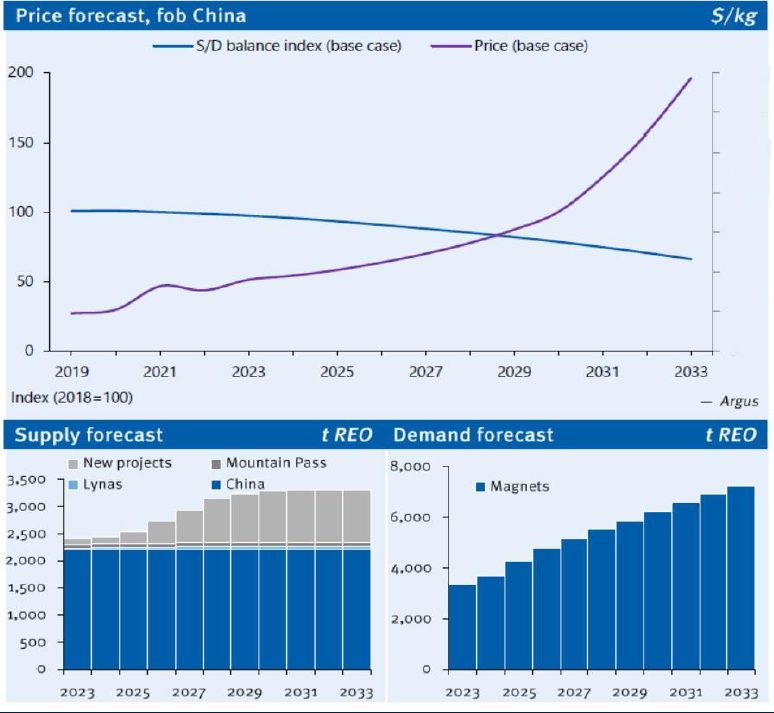

Since 2020, the price of dysprosium has been anything but steady (check the historical Dysprosium price graph here). After almost doubling in 2020, prices have seen a correction, presenting a unique buying opportunity for savvy investors. Analysts agree that with the exponential growth in demand, particularly for green technologies, and China’s tight grip on supply, the price of dysprosium is poised for significant gains in the medium term.

A Future-Ready Investment

As the accompanying graphs by Argus Media illustrate, demand for dysprosium is set to far outstrip supply over the next decade despite new production outside China. This imbalance is why many analysts forecast a quadrupling of dysprosium prices in the next 10 years. For investors looking to position their portfolios for the future, dysprosium offers a compelling case as a medium to long-term investment.

Seize the Opportunity

Now is the time to consider dysprosium as a strategic investment. As the world accelerates towards a green economy, the demand for this irreplaceable metal will only intensify. Request a quote today to secure your share of dysprosium and future-proof your investment portfolio.