Rhenium: A Rare Metal with a Bright Future

November 9, 2022

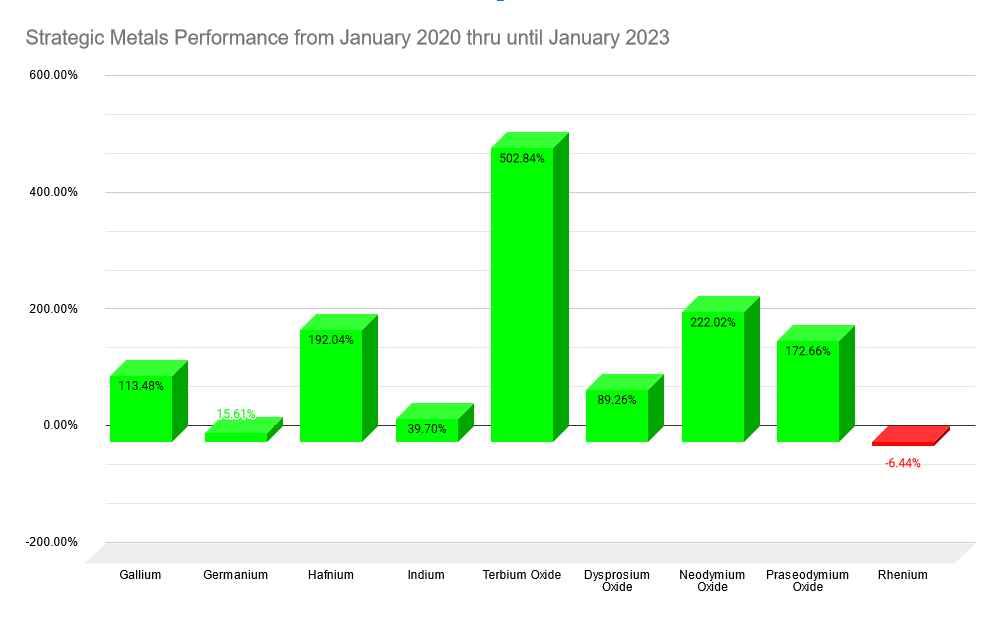

Rare Earths Performance UpdateThe Decade so Far

January 6, 2023It’s no secret that owning Rare Earths as physical assets have been profitable for investors. Here we want to give you the data on why this has occurred and the evidence (independently sourced) on why this will continue until the 2040s and beyond.

The great fact about owning Rare Earths is you are invested in ALL industries. As an investor, you will enter the value chain right at the very beginning by owning the raw materials that are the backbone of manufacturing in the 21st century. I cannot think of an industry you would not have access to by owning Rare Earths. If you can think of one, let me know.

It is estimated that the demand for Rare Earths is between 6 to 9 times greater than the supply depending on the industry and the metal needed.

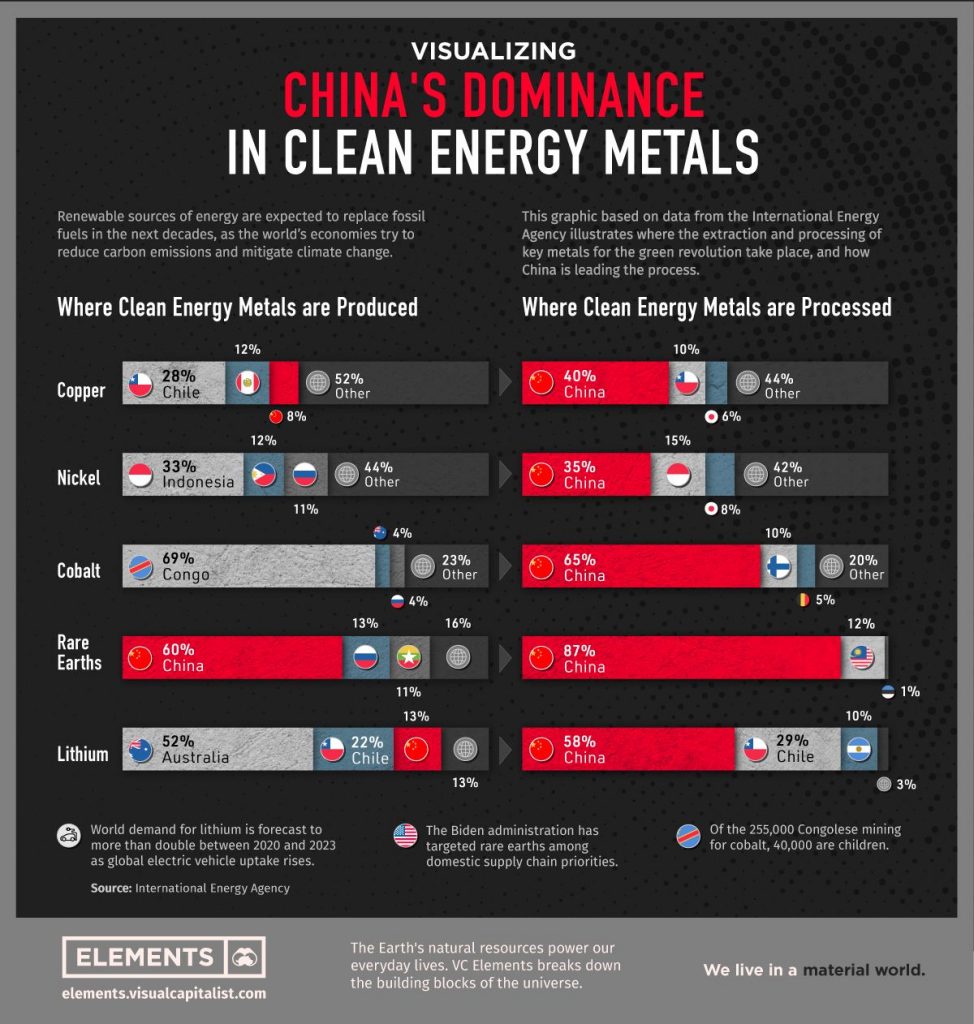

Let’s start with supply, please see our chart below (Source: International Energy Agency), which demonstrates that supply is controlled by one country. Rare Earths are crucial to a nation’s economic prosperity and, increasingly, to a nation’s military capabilities. Therefore, it is not a good idea for the global supply to be monopolized by one country. Look closely at Rare Earths processing. China is responsible for 87% of the world’s processing/refining. It’s the processing and refining that makes Rare Earths expensive. The war is over, and China has won, at least in Rare Earths.

Now let’s look at demand focusing on one particular industry for now. Globally, we are going through the greatest transformation in our planet’s history: our transition to low-carbon economies. It has already begun, as we know; however, it is estimated that the demand for energy transition metals will not peak until the 2040s.

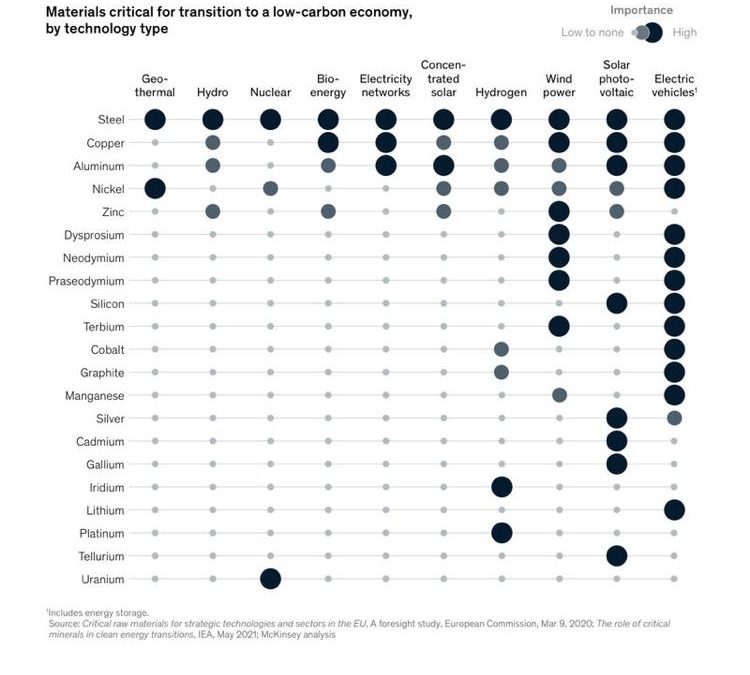

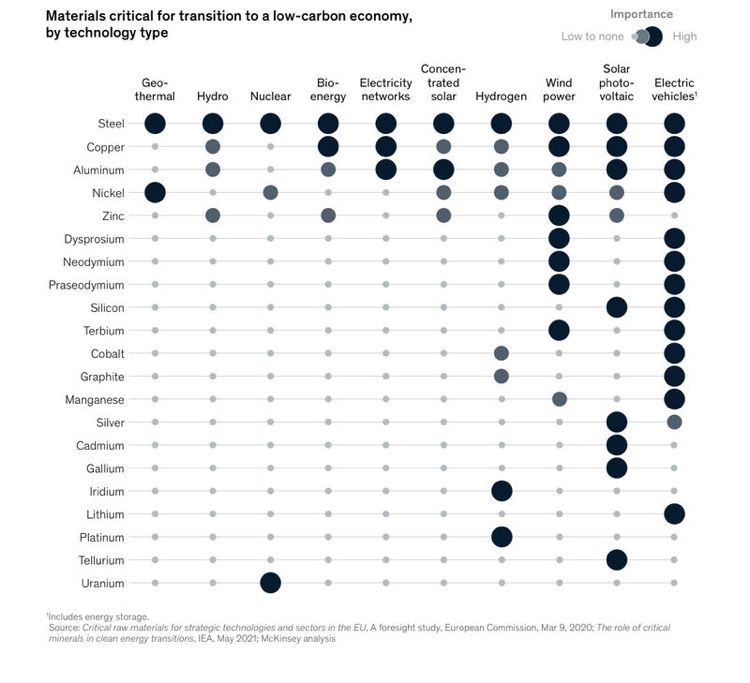

Please see our graph below demonstrating the critical raw materials (Sources: EU/European Commission/McKinsey) needed for our transition to low-carbon economies. Seven of the nine metals we offer are listed as critical energy transition metals (as well as having many other applications.) Dysprosium, Neodymium, Praseodymium, Terbium, Gallium, Indium andTellurium.

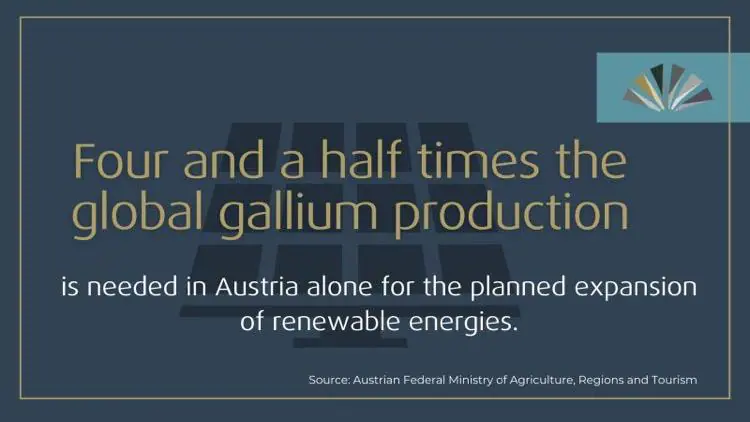

Our next graphic below ( Source: Austrian Federal Ministry of Agriculture, Regions and Tourism) demonstrates just how staggering the gap is between supply and demand. It illustrates how much Gallium is needed in one small country alone, Austria, for their planned expansion to renewable energies. It is estimated that the demand for Gallium is 9 times higher than the supply. Gallium is up 50% a year every year for the past 5 years.

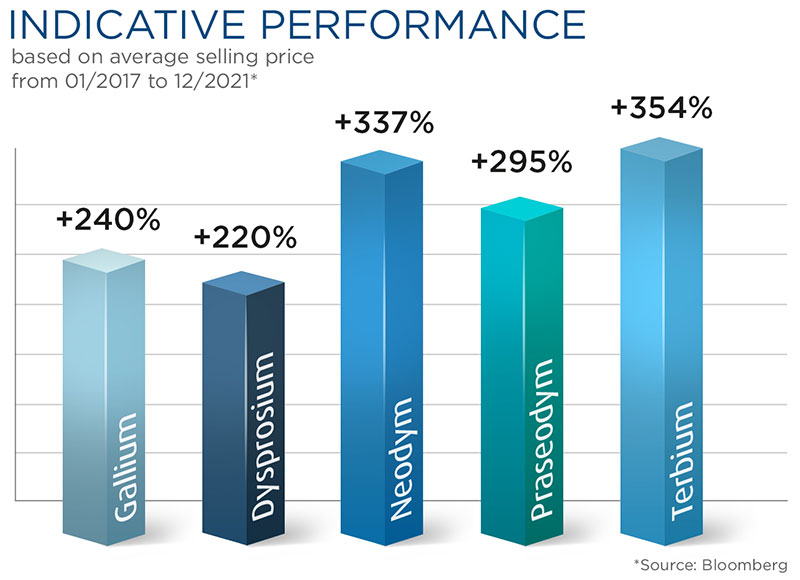

Speaking of price increases and Rare Earth Metals’ performance as an asset class, our last graphic for today demonstrates the historical price/performance for the past 5 years. Please see our final chart below (Source: Bloomberg) for our top 5 metals. Our top performer, Terbium is up an incredible 70% year on year since 2018. Full disclosure, the average gains across all metals we offer is 34.25% year on year since 2018.

If you purchase Rare Earths as physical assets, we recommend that you diversify by purchasing all 9 Rare Earths we offer, thus having a stable base portfolio and diversification in all industries. That is your decision, though, as you are the buyer and can buy 1 or 2 or 3 or any combination of metals you wish. Some of our clients prefer to focus on one particular industry, for example, and purchase the 3 or 4 metals specific to that industry.

If you would like to investigate further or have a general chat about Rare Earths please let us know, and we will be happy to have a call with you.