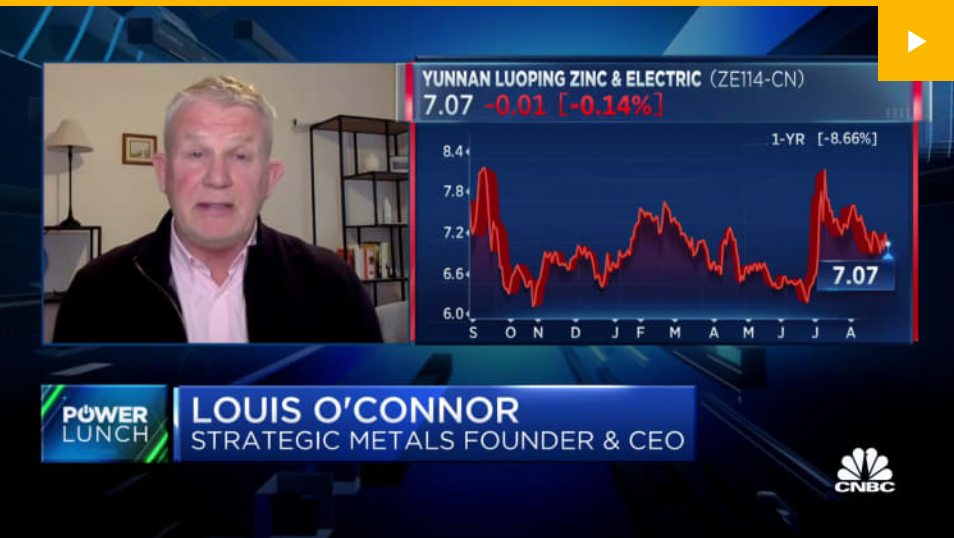

Our CEO Louis Breaks down China-U.S. Rare Metal Wars on CNBC

August 30, 2023

Understanding the Volatility of Strategic Metals – First Principles Explained

November 29, 2023Despite the name, the U.S. Inflation Reduction Act is primarily about the transition to a low-carbon economy.

The massive shift from fossil fuels to renewable energy will place “energy transition metals” at the center of a cleaner, more connected, and sustainable world.

What is not widely known is that supply in the sector is poorly placed to respond to the rising demand globally.

How can investors profit? By owning the raw materials (energy transition metals) that are critical to the greatest energy transition in the history of North America, AKA the “renewables revolution”.

We are at the beginning of a perfect storm where the demand will far outstrip the supply globally between now (2024/2025) and 2030.

To make our point, we demonstrate here why the focus on the U.S. in earlier versions has since been reworked to include other nations.

Initially aimed to overhaul the U.S. economy as it arose from the COVID-19 pandemic, the Act raised over $700 billion in revenue to control inflation, combat climate change, revise the healthcare sector, and make the energy infrastructure and supply chains more resilient.

President Joe Biden signed the Inflation Reduction Act (IRA) into law on August 16, 2022, aiming to curb inflation and reduce the federal deficit while promoting clean energy investments in the United States.

The IRA is arguably the most significant climate legislation in American history: The Act will invest in domestic energy production and manufacturing and aims to reduce carbon emissions by roughly 40 per cent by 2030.

The IRA has three dominant areas of focus: Healthcare, Energy Security, and Climate Change. The Act’s initial focus on investments in the domestic United States economy, however, evoked fears in the European Union about the future of the competitiveness of the European industry.

Build Back Better –

Before his inauguration, President Biden laid the foundation for the Inflation Reduction Act by announcing his “Build Back Better” agenda. The agenda consists of overhauling the neglected domestic U.S. energy infrastructure, modernizing the U.S. auto industry, and making drastic investments into clean energy and sustainability across the entire U.S. economy.

With increasing inflation rates worldwide, the Russian invasion of Ukraine, and subsequent skyrocketing energy prices, the Biden administration was forced to reform their proposals to include corresponding measures to curb inflation. The “Build Back Better” agenda was improved into the Inflation Reduction Act after year-long negotiations among the Democrats over the financing and general approach of transitioning to clean energy.

The Act in Detail –

The Inflation Reduction Act aims to reshape the U.S. economy as it emerges from the Covid-19 pandemic. In total, the IRA raises over $730 billion in revenue, of which the majority will be generated through a newly imposed 15% corporate tax on large companies and the remainder through a combination of reforming prescription drug pricing and stricter tax enforcement through the IRA.

Of the $730 billion raised, $370 billion is allocated for investments in climate and energy policies projected to cut the U.S. carbon emissions by approximately 40% by 2030, according to Democrats.

Approximately $64 billion of the revenue raised will be used to extend the Affordable Health Care Act. In comparison, the remaining $300 billion will be spent to reduce the U.S. federal deficit to combat inflation.

However, the total deficit reduction has been questioned by Republicans who argue that the new 15% corporate tax will have the opposite effect of curbing inflation and will increase prices instead.

Analysts such as the credit rating agency Moody’s agree that the IRS’s short-term impact will be insignificant but expect positive medium and long-term results for the U.S. economy.

Here are the three packages in detail…

Healthcare Package –

The Inflation Reduction Act allocates $64 billion for the healthcare sector, extending the Affordable Care Act program implemented during the height of the COVID-19 pandemic for three years through 2025. Additionally, the IRA aims to reduce the price of prescription drugs by authorizing Medicare to negotiate prices for certain drugs with pharmaceutical companies, which is a significant source of the total revenue raised for the IRA.

Climate Change Package –

The Inflation Reduction Act (IRA) is the most significant climate bill in United States history, with an estimated $369 billion budget for climate spending over the next ten years in subsidies, tax credits, and loans.

The Act places the U.S. on a path to reaching its 2030 climate target of cutting carbon emissions by 40%. To achieve this, the IRA provides businesses with tax credits and loans for investments in wind, solar, biogas, and geothermal energies to incentivize the deployment and research of lower-carbon and carbon-free energy sources and technologies.

Nuclear and hydrogen energy sources are also applicable for tax credits, as well as technologies that capture carbon from fossil fuel power plants, such as carbon capture and storage.

Fossil fuel companies like ExxonMobil have invested millions of dollars already in these new technologies and will thus also benefit from the IRA.

Additionally, the IRA contains tax credits for purchasing used and new E.V.s (electric vehicles). The early versions of the IRA specified that these tax credits only applied to projects and E.V.s that utilize domestic U.S. suppliers or manufacturers.

This has since been extended to other nations, such as Japan.

Energy Security Package –

The IRA aims to lower energy costs for individuals and corporations by promoting investments in new energy technologies and clean energies.

In addition to incentivizing new projects, the IRA provides tax credits for energy-efficiency home improvements.

The combination of investing in clean, domestically produced energy as well as incentivizing energy efficiency, the IRA aims to increase the resilience of the U.S. power grid as well as reduce the dependency on fossil fuels considering the Russian invasion of Ukraine and the connected skyrocketing energy prices.

Likewise, the reliance on Chinese and Russian rare earth elements is another issue tackled by the IRA. The act tax credits for domestic manufacturers of “eligible components” include critical rare earth elements to produce magnets used by wind turbines and E.V.s: Neodymium, Dysprosium, and Praseodymium.

European Reaction –

The IRA was initially focused entirely on the domestic U.S. economy. Hence, the proposed tax credits were only applicable to projects and products that are US-made or consist of US-made components.

High energy prices following the Russian invasion of Ukraine were already causing fears of de-industrialization in the E.U. before the passage of the IRA.

With skyrocketing energy costs, manufacturers in the E.U. risked being forced to make tough decisions on relocation or shutting down operations entirely. The one-sided nature of the initial versions of the IRA further intensified these fears.

However, after monthlong negotiations between the U.S. and its trade partners, the tax credits and subsidies have been extended to other countries, and negotiations with the E.U. are ongoing.

The backdrop to this from an investment perspective is that the raw materials needed for this global transition are limited in supply. China dominates the processing and supply of energy transition metals. Industry experts agree that China’s next move is up the value chain. Now that they have achieved dominance China can and will take advantage as they have big plans domestically for electric cars, solar and wind power.

If you would like to learn more about owning the energy transition metals, Gallium, Dysprosium, Neodymium, Praseodymium, and Terbium, please contact us.