Weekly News Review January 5 – January 11 2026

January 11, 2026

Weekly News Review January 12 – January 18 2026

January 18, 2026If 2024 was about positioning, 2025 was about confirmation.

Across technology metals and rare earths, the past year delivered what strategic-metals investors rarely see all at once:

Tight supply, visible policy pressure, and demand that refused to cool, even as broader markets lurched between optimism and anxiety.

The result was one of the strongest calendar years we’ve seen since Strategic Metals Invest began tracking these markets.

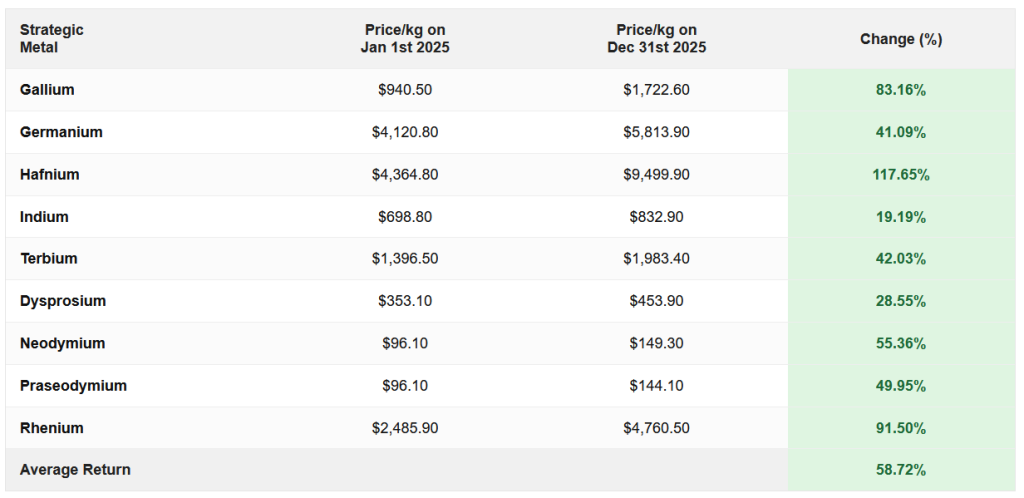

Strategic Metals Performance — Calendar Year 2025 (USD)

An average return approaching 60% in a single year is not something we take lightly, and it certainly wasn’t driven by speculation alone.

Why 2025 Was So Strong — Metal by Metal

Gallium (+83%)

Export controls stopped being a headline and started becoming a structural feature. With China tightening licensing and Western semiconductor demand remaining firm, gallium prices repriced to reflect strategic scarcity rather than marginal production cost.

Germanium (+41%)

Fibre-optic infrastructure, infrared optics, and defence-related applications kept pressure on a market already constrained by by-product production. Germanium’s move in 2025 was steady rather than explosive. A classic example of supply friction doing its work quietly.

Hafnium (+118%)

The standout performer of the year. Hafnium sits at the intersection of aerospace, turbines, and advanced semiconductors; all sectors that expanded simultaneously in 2025. With no primary mines and extremely complex separation economics, prices adjusted rapidly once inventories thinned.

Indium (+19%)

The most “boring” metal of the group, and that’s a compliment. Indium remains essential to displays, photovoltaics, and electronics, but with better recycling and slower-moving supply chains, its gains were incremental rather than dramatic.

Neodymium (+55%) & Praseodymium (+50%)

Permanent magnet demand once again surprised on the upside. Electric motors, wind turbines, and industrial automation absorbed supply faster than anticipated, while substitution efforts continued to disappoint. The market responded accordingly.

Rhenium (+92%)

Rhenium quietly did what rhenium does best: remind the market that ultra-rare, irreplaceable metals don’t need hype to move. Aerospace demand and refinery catalyst consumption collided with limited by-product supply, and prices followed.

Dysprosium (+29%) & Terbium (+42%)

Heavy rare earths remain the pressure points of the magnet world. Even modest demand growth has an outsized impact when annual global production is measured in hundreds of tonnes.

However, these two deserve a special mention because during 2025, sales of Dysprosium and Terbium to new private investors were temporarily halted as available volumes were increasingly absorbed by industrial demand. To facilitate deliveries to industry clients, enhanced buyback prices were offered to existing investors, reflecting real transactional demand rather than published reference prices.

Converted Buyback Prices and Performance(USD)

Dysprosium: €700 × 1.17 = $819.00 / kg -> +131.96% Terbium: €3,030 × 1.17 = $3,545.10 / kg -> +153.82%

What This Shows

While the published year-end prices showed respectable gains of 28.6% for Dysprosium and 42.0% for Terbium, the actual executable prices offered during the year tell a more revealing story.

In both cases, returns exceeded 130% within a single calendar year when material was redirected to industrial clients, not because of speculation, but because availability became the constraint.

This episode neatly illustrates a defining feature of heavy rare earths:

Prices move not when demand is discussed, but when supply disappears.

For Dysprosium and Terbium in 2025, that moment clearly arrived.

What 2025 Really Demonstrated

Three lessons stood out last year:

- Critical metals behave differently from commodities

These are not markets driven by sentiment or financial flows, but by engineering constraints and policy decisions. - Export controls don’t create spikes — they create floors

Once material is classified as “strategic,” prices rarely return to prior lows. - Scarcity matters more than demand growth

Even modest increases in end-use demand can overwhelm supply when production is structurally capped.

Looking Ahead

What 2025 demonstrated very clearly is that strategic metals no longer move in isolation. Policy decisions, industrial stockpiling, defence procurement, and energy infrastructure are now acting together, reinforcing price pressure across multiple metals at once.

As we move into 2026, several developments are already worth watching closely:

- Ongoing export controls and licensing regimes

- The widening gap between material availability and published reference prices

- Growing competition between industry, governments, and strategic stockpiles

- And the increasing tendency of manufacturers to secure supply before shortages become visible

Rather than speculate here, we’ll dedicate next week’s update to a deeper look at what these dynamics could mean for 2026.

For now, 2025 stands as a reminder of something we’ve said often, but which the market occasionally forgets:

In strategic metals, the biggest moves usually begin before they are widely discussed.

As always, please don’t hesitate to contact us if you’d like to discuss how physical strategic metals can be added to your portfolio.